For most people, retirement means something that only older people do after decades and decades of working. However, more and more people are thinking about early retirement. And, when I say early retirement, I mean being financially secure enough that you don’t need to work unless you want to.

Even though it takes a lot of work and planning to retire early, some people seem to think that early retirees aren’t very smart, are lazy, or even boring.

I see this a lot when I read articles about people who have retired early. I always scroll down to the comments of these articles because I find it interesting to see what people have to say about early retirement. I’m always shocked, and saddened, when I read comments that say these early retirees are being careless and won’t be able to live exciting lives after they retire.

Some people assume these people haven’t saved enough and are naively thinking their money will last forever. Some assume early retirees just want to stop working because they are lazy. Others think that early retirees just sit around all day and do nothing in order to save money.

However, none of these common myths about early retirees are true!

And, I just don’t understand these negative feelings about early retirement because I personally love the idea of people striving to retire early.

Really, what could feel better than working hard to your save money, investing it well, and then realizing the financial freedom you have to quit your day job so you can live your dream life!?

Whether you want to travel, continue working (yes, you can continue working your job! There’s no rule that you have to quit), spend more time with family, or whatever else, retiring early gives you the ability to choose your own future.

Plus, early retirement can be at whatever age you want it to be, it doesn’t have to be that you retire early at age 30. If you are able to retire at age 60, that’s awesome! The point is just to strive to better yourself so that you can be financially free and not stuck and miserable in debt, and/or living a paycheck to paycheck life.

Sadly, there are many out there, who do not save enough money when preparing for retirement. According to one survey, 56% Of Americans Have Less Than $10,000 Saved For Retirement. According to a different survey done by Bankrate.com, 36% of people in the U.S. have absolutely nothing saved for retirement.

Due to the above, I think it’s obvious that more people should make saving for retirement a priority.

And, even if you love your career, you can still think about early retirement.

I have saved enough to retire whenever I would like. Yes, I earn a high income, but I also save a large part of my income and watch any wasteful spending.

Now, don’t get me wrong, I absolutely love life and my online business. However, knowing that I can retire early means I am prepared for whatever might happen in the future. As you know, I’m a worrier, and I would much rather be safe than sorry. There are so many what ifs, like there could be a medical emergency, the industry may change, I may change, and so on.

You just never know what may happen in the future!

Related:

- 21 Best Early Retirement Tips To Help You Retire Early

- 13 Best Early Retirement Books

- What You Need To Know About Investing, Retirement Planning, and More

To me, having the ability to retire early is all about freedom and flexibility.

Now, I’m not going to automatically assume that extreme early retirement is for everyone. Because, it’s not.

Not all early retirement paths have to be extreme – some can actually be quite normal. Many people can still live a normal life, without really cutting too much out. It’s all about being realistic with your income and spending.

The majority of the population does not seem ready for retirement at any age, let alone the retirement age of around 65-67, so to discount early retirees altogether just seems crazy to me.

Whether you’re thinking about early retirement, still planning for a “normal” retirement age, or are just confused about what these early retirees are thinking, this post will, hopefully, debunk any myths you may have about early retirement.

Related content:

- How I Retired In My 30s – From Ugly Crying To Retiring Just 10 Years Later

- How This 28 Year Old Retired With $2.25 Million

- The 6 Steps To Take To Invest Your First Dollar – Yes, It’s Really This Easy!

- Are Your Excuses Making You Broke And Unsuccessful?

- How can I be financially independent and retire early?

Are early retirees dumb, lazy, and/or boring?

Are early retirees naively thinking that their money will last forever?

This is one of the most common myths I hear about early retirees. Many like to assume that early retirees haven’t thought about possible future expenses, such as from having children, health insurance costs rising, inflation, the stock market dipping/crashing, and more.

However, planning for early retirement definitely takes all of these expenses into consideration.

For most early retirees, it starts with creating a budget that allows them to really know their expenses and save for them well into the future.

Related content: The Complete Budget Guide: Creating A Budget That Works

A person planning for early retirement is thinking about all of these what ifs well into the future. While no one’s calculations are going to be correct down to the penny, it is possible to factor in possible future expenses.

Still, many people don’t believe that early retirement is possible. I have heard countless people say that retiring early is dumb because $1,000,000 – $5,000,000 isn’t enough to retire young, that early retirees aren’t thinking about future expenses, etc.

I believe this has a lot to do with the fact that many people don’t understand compound interest and investing. Both of these things let your money work and grow for you, well into the future, meaning that an early retirees’ retirement funds are most likely going to grow well into the future. I have seen countless comments where a person just divides $1,000,000 by 50 years and assumes that the early retiree is living off of $20,000 a year and not a penny more for the rest of their life.

However, that’s not how investing and early retirement works.

If you want to learn how investing works and how you can start saving for early retirement, read more at How To Start Investing.

Honestly, early retirement is possible.

By saving enough of your money and living off a designated percentage of your savings or invested income each year after you retire early, you will find that early retirement is possible.

Before throwing the whole idea out, you may want to look into how it may be possible for you.

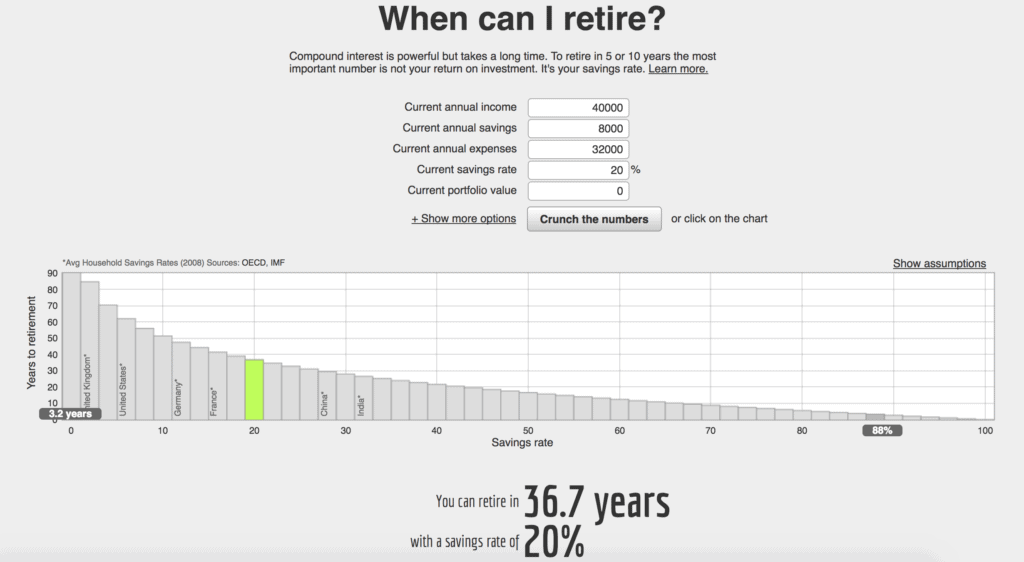

As you can see from the above:

- With just a 1% savings rate, it would take you 98.9 working years until you reach retirement.

- A 5% savings rate means that it would take you 66 working years to retire.

- A 20% savings rate means that it would take you 37 working years to retire.

- A 50% savings rate means that it would take you 17 working years to retire.

- A 75% savings rate means that it would take you 7 working years to retire.

So, by saving more of your money, you are likely to retire sooner. Makes sense, right?

Related content: Do You Know Your Net Worth?

Are early retirees lazy and just not wanting to work?

I’m going to be honest, this myth is absolutely crazy! If you are planning for early retirement, you definitely aren’t lazy. Like I said before, it takes a lot of planning and forethought to retire early. It’s not at all for the lazy!

However, I have heard so many people say this about early retirees. And, I think it’s the exact opposite.

If you are looking to retire early, you probably aren’t the type to just sit around all day. I mean, if that’s your plan for after you retire, that’s totally fine because you get to choose. But, for many, early retirement isn’t just about not working. It’s about having the freedom to spend your time pursuing your passion, traveling, spending more time with friends and family, and more.

Still, I have heard so many times that early retirees are lazy and are just looking for a way to escape the work world and essentially be homeless, live in a shack, eat rice and beans, etc., instead of working.

I believe early retirees are hard workers who want to live life on their own terms. After all, they had to save enough to retire early some way – and I’m sure it wasn’t due to any laziness.

Don’t early retirees just sit around all day in order to save money?

I have heard countless people say that early retirees are boring, lead meaningless lives, and probably just sit around all day doing nothing. Some of these same people justify not saving for retirement by saying that they’d rather work until they’re 70.

I don’t know how much fun the average person has while working, but I’m fairly positive that the average person is probably not in love with their job. In fact, it is somewhat rare for a person to be absolutely in love with their job. Yet, I still hear this myth all the time.

An early retiree isn’t just going to sit around all day. Even if that’s what they want to do, who cares?! Retiring early certainly doesn’t mean that you have to be bored.

With all the extra time you have after retiring early, you could volunteer, pursue a passion, find fun things to do, take up a hobby, and more.

Heck, you could even continue working, if that’s what you truly desire. Early retirement just gives you choices in case something changes in the future.

I know that for me, if I chose to stop working one day, I could easily find time to fill my day outside of work. I could travel even more, go on more long hikes, be more fit, read more, learn more (I’ve been wanting to learn a new language), find a passion project, spend more time with friends and family, etc. The list is endless!

The average early retiree, that I know, has a very active and meaningful life. They don’t need work in order to feel valued in the world; instead, they find other things to make themselves happy.

Plus, just because you are saving for retirement doesn’t mean you are eating ramen noodles for breakfast, lunch, and dinner. However, this is a myth that is often associated with early retirement.

Sure, a person who seeks early retirement or who has already retired early may be frugal, but I highly doubt that the majority of early retirees live boring and uneventful lives.

There are plenty of ways to have frugal fun, eat on a budget, and so on. You can even see the world, while saving for early retirement, too. We currently live in our RV, while traveling North America (yes, I know that’s not the world), and we have met many early retirees who are doing the same. Remember, the best things in life are free. The outdoors, spending quality time with those you love, laughing, and more are all FREE.

When do you want to retire and when WILL you retire? What do you think of early retirement?

Leave a Reply