Hello! Today, I have a great article from JT. JT has a great story about how he was down to his last dollars living in a hostel, to hitting his retirement number just a little over a decade later. If you’re looking for another great retirement article, I also recommend How This 28 Year Old Retired With $2.25 Million. Below is his article on how to retire in your 30s. Enjoy!

Have you ever seen a grown man ugly cry? Our faces scrunch up like a squeezed sponge, wringing the water from our eyes. Our shoulders shake uncontrollably. We gurgle out a noise that’s a cross between a laughing hyena and a grunt. We’re not pretty.

It was 2000. I was ugly crying on the bed of the Spanish Harlem hostel where I was living, down to my last dollars. Months earlier, I graduated college, sold my car, and drove from Los Angeles to New York City with sunny West Coast optimism. Then after months of getting rejected from job after job after job, reality blew in like an East Coast blizzard.

They say, “New York City: If you can make it here, you can make it anywhere.” For those of us who have tried, it can feel more like, “Since I can’t make it here, I can’t make it anywhere.”

I wasn’t crying because I failed. I was ugly crying because I thought I was a failure.

And yet, a little over a decade later, I hit my retirement number. So what happened between the tears of sadness and the tears of joy? I’ll tell you exactly what I did to hit my retirement number in my 30s.

Related articles on how to retire in your 30s:

- The 6 Steps To Take To Invest Your First Dollar – Yes, It’s Really This Easy!

- Are Your Excuses Making You Broke And Unsuccessful?

- 56% Of Americans Have Less Than $10,000 Saved For Retirement

- 75+ Ways To Make Extra Money

What is Your “Retirement Number?”

First, let me define what I mean by retirement number. It’s not just sitting under an umbrella on a faraway beach sipping fruity cocktails (although that would be nice!). It’s simply the point where if you were to quit working, you could still cover your basic needs. Basically? It’s when going to work is a choice.

You might find out, like I did, that you actually want to keep working. The best part of reaching your retirement number isn’t money, it’s agency. It’s the ability to spend your time the way you choose — unless you have little ones like I do waking you up at 6:00am every morning!

Sound pretty good? Here are my 6 steps to find out your retirement number and how to reach it. I’ll spend more time on the first 2 because they are the foundation for the remaining 4 steps. The math might seem a little intimidating at first, but if you write it down on paper, you’ll find that it’s not too bad. As you’ll see, you don’t have to be a math or money genius to retire early!

The 6 Steps to Retire in Your 30s:

Budget to a Balance Sheet:

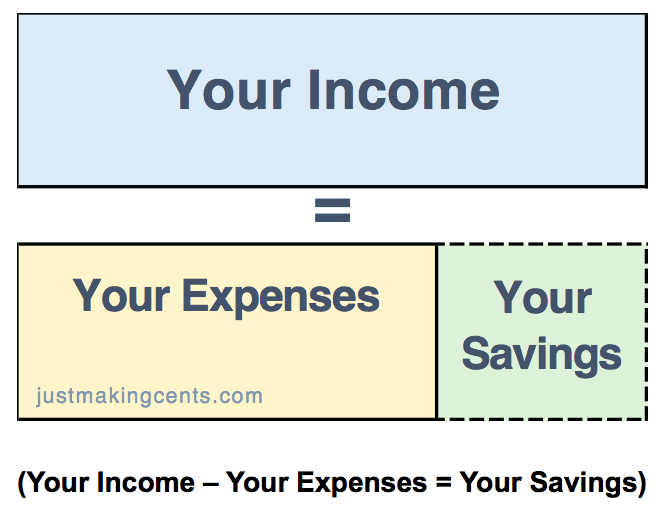

When many of us think about our finances, we focus on what’s called the “income statement.” As a result, the budgets you see are most often just an income statement, like this:

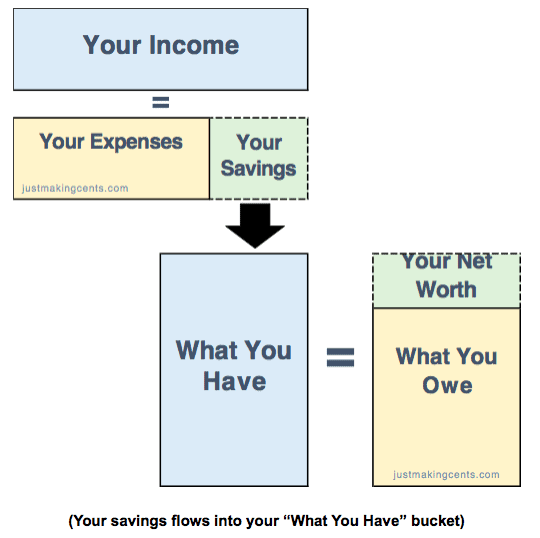

Understanding your savings amount is a good starting point, but it’s where most people stop. Instead, use it as a starting point. The savings amount from your income statement is there to help make your “balance sheet,” which is just a fancy way of understanding what you have and what you owe. It will take some time go gather up your statements, but it’s not harder to make than your income statement.

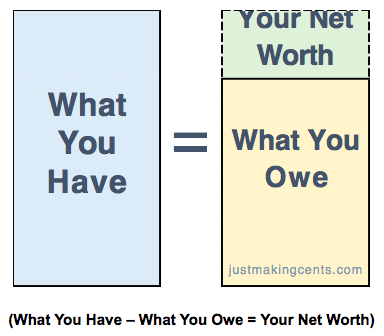

Your balance sheet is basically:

Your savings amount flows into your “What You Have” bucket since that savings is now what’s called an “asset.” Think of it like when you eat cashews and have several left in your bowl. You’d go and put the remaining cashews back into the bulk container. Those cashews just went from leftovers to future snack.

Next, add your investment account balances to your “What You Have” bucket. Don’t include your car, house, jewelry, or any other physical things unless you actually plan to sell them within a year. You’re trying to figure out all your “What You Haves” that can be used to fund your living expenses, and last I checked, biting into your steering wheel wasn’t all that filling.

“What You Owe” is your credit cards, student loans, mortgage, and that loan you took out from your uncle. The technical term for these is “liabilities.” So, once you organize your information, you basically have your balance sheet. You’ll see in the next steps why having a good grasp of both your income statement and your balance sheet is so important.

Know Your Retirement Math:

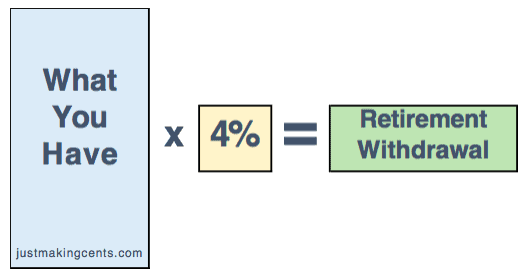

A study by financial planner William Bengen found that if you withdraw 4% a year, your money would last you at least 30 years if you had a 50/50 portfolio of stocks and bonds. Others have found that most of the time (although on a 60/40 stock/bond portfolio), you would actually end up with more than when you started.

Bengen got to this 4% rate by back testing the withdrawal rate that would have worked even through the Great Depression, basically taking the worst case scenario in history.

The 4% withdrawal rate is a helpful guide for knowing how much to withdraw, but not very helpful to let you know how much you should have to withdraw from. To find that, you’ll need to convert it into a goal. We’ll start with the 4% withdrawal equation:

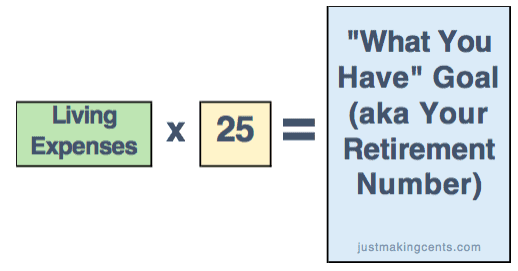

But that’s not a goal. It’s basically where you are today if you were to try to retire early. To convert it into a goal, you’ll need to do some mathematical jujitsu with the equation above (not to worry, I did it for you!). It’s the same equation, but I’ve mixed it in a blender to make it more helpful:

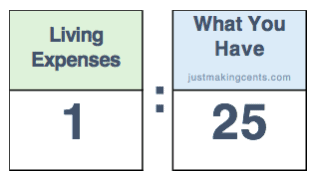

If you look carefully, I just reversed the “retirement withdrawal” equation. I changed the “retirement withdrawal” to “living expenses” and inverted the 4% to make it 25. By doing this, you can get to your “Retirement Number” goal.

You might be thinking 25 times your expenses is a big, scary number. It can seem unreachable. But, I’m excited to show you how it can work in your favor. To do that, turn the “25 times” into the ratio:

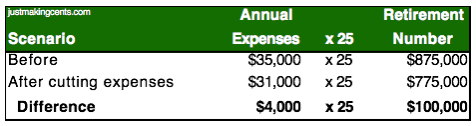

When you look at it as a ratio, you can see the power of reducing your expenses. For every $1 you shave off of annual expenses, you’ll need $25 less in your “What You Have” bucket to hit your retirement number. To illustrate how powerful this is, let’s look at an example: Say you spend $35,000 a year but shaved off $4,000 in expenses. Take a look at what happens:

If you put your money into the stock market, you might get the historical 7% annual returns. Your account might get bigger. But it also might get smaller. But if you cut expenses, you’re guaranteed to get a 2,500% return! ($4,000 savings x 2,500% = $100,000 effect on your retirement number)

Isn’t math fun?

You’ll notice I’ve only focused on “What You Have,” so why did I want you to know your entire balance sheet? It’s a little circular, but I think you’ll get it one you think about how the income statement and balance sheet talk to each other:

Reducing your expensive “What You Owe” (like credit cards) items on your balance sheet leads to…

Lower expenses on your income statement, which leads to…

Higher savings on your income statement, which leads to…

Increasing your “What You Have” on your balance sheet, which leads to…

Hitting your retirement number sooner!

So don’t ignore your “What You Owe” number. The sooner you get rid of your high interest rate ones like credit cards, the sooner you can hit your goal.

Alright, so how are we going to apply this to our actual lives?

(Do you wish you knew how to do this when you were younger? Would you like to teach it to your child? I’ll show you how teaching your children about money can be fun, fast, and easy starting here. Download the FREE Guide to Helping Your Child Start Their First Business and you’ll also get access to a FREE course on how to get your finances in shape for early retirement!)

Make As Much As You Can:

I know — you’re shocked!

Even though it’s basic, let’s take a moment and think through the implications of what this means. It means that if you’re serious about retiring early, you don’t work for passion. You work for money. If Goldman Sachs is offering you a job but you’d really rather be glassblowing, take the Goldman job, hang in for as long as you can, then retire early and spend the rest of your life glassblowing. Till the ground now so that you can enjoy the fruit of your harvest later.

As for me, I persisted and eventually found myself at a hedge fund that allowed me to stay in New York City. But most of us don’t have the opportunity to immediately get a six figure job. What then?

Side hustle.

Michelle has 65 Ways to Earn Extra Money. There should be at least one that tickles your fancy. Remember, you are trying to increase your income so you can increase your savings so you can increase your “What You Have.”

So that I could extend my runway until I could get a full-time job, I worked as a sales associate at Banana Republic. When I finally did land a full-time job, much to my friends’ puzzlement, I kept my sales associate job and turned it into a side hustle. (Imagine how mortified my boss at the financial firm where I worked felt when she ran into me at Banana Republic!). My balance sheet thanked me, as it helped me quickly pay off my “What You Owe” items, including student debt.

Change Your Spending Mindset:

Change your default question from “What can I afford?” to “What can I withstand?” Often times, when we get an upgrade in pay, we too often automatically think we need an upgrade in lifestyle. Why default to this assumption?

Let’s say you just got a promotion that is paying you $5,000 more a year. You’re tired of asking your roommate clean up her dishes. Your car is fine, but basic. You think about how hard you’ve been working and how you deserve your own place and a new car.

We’ve all felt this tug to spend more. But as we’ve seen in step 2, the ability to minimize your spending is the most powerful thing you can do to reach your retirement number.

Even though I was making six figures, I lived with roommates in non-prime areas of Manhattan until I got married. I never had a doorman. I hardly took cabs. I stayed in and cooked most nights. Within a few years, I paid off $15,000 of school debt and started building up my net worth.

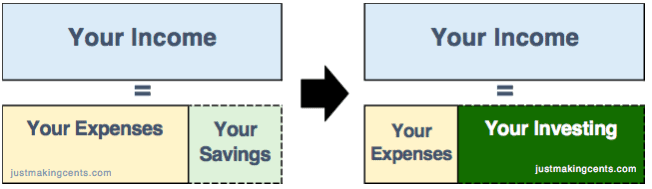

Invest (Almost) Everything:

Saving is not the same as investing. Saving is the act of putting money away for a rainy day. Investing is putting money to work. In fact, if you simply save without investing, you actually lose money due to inflation.

After you’ve saved enough for 3 to 6 months of living expenses, invest the rest. The S&P 500 has historically returned 7% a year, after inflation. Meanwhile, the average annual salary raise has been around 3%. This difference is huge! It means that at a certain point, your investments will actually start making more than what you’re saving per year. Then, with enough time, it will actually start making more than your entire annual salary!

Basically, you’re trying to shift your finances from the picture on the left to the picture on the right.

Now, the last step can be tricky, but greases the path to your goal.

Move to a Lower Cost Area:

This is the trickiest part but also has the most potential to get you to your early retirement goal. An easier way to do this is finding an employer that also has a location where you want to be. For the East Coast, that’s either moving from Manhattan to a borough like Queens or transferring to another city like Philadelphia or Stamford. On the West Coast, it’s like moving from San Francisco to Portland. (Or, for the ultimate move, live in an RV and see the entire country like Michelle!)

A few years ago, I moved to Philadelphia while keeping my New York City salary. In so doing, I significantly reduced my housing expense by thousands of dollars…every month. With that one move, because I reduced my biggest expense, my wife was able to stay at home with our 3 children. In other words, it allowed my wife to retire (although her work as a SAHM is much more challenging than mine!). At the same time, I was still able to accelerate our retirement timeline by decades!

So, if reducing your expenses is the most powerful thing you can do to reach your retirement number, cutting your housing expense is the most powerful thing you can do to reach your expense reduction goal.

But Can You Really Hit Your Retirement Number Before 40?

Let’s put all six steps together.

You’ll see that it can be done without making six figures. Let’s say you make $50,000 out of college and have a side hustle that makes you an extra $12,000 a year (I based this on the 20-25 hours a week I worked at Banana Republic while keeping my full-time job). Also, you live with a roommate and pack lunches most days a week and only occasionally eat out for dinner.

- Your salary and expenses each increase 3% a year, which is in line with historical inflation.

- Your investments earn 7%, which is the historical S&P 500 return above inflation.

- At ages 28 and 34 you get a promotion, getting a $5,000 bump in salary each time.

- Your first promotion at 28 gave you more responsibilities, so you decided to quit your side hustle.

At age 34, you move to a lower cost part of town, reducing your living expenses by 15% over the prior year (yes, it’s possible – I saved more than this moving from Manhattan to Philadelphia).

As you can see, by the time you’re 39, you could withdraw almost $43,000 a year. So, if you were this person and quit your job at 39, you’d have enough to cover living expenses and taxes until social security kicks in.

As you can see, it’s possible even if you don’t have a big salary. So the real question is not “can you?” but “do you?” Do you have the desire to transfer the math into your actual lifestyle? Do you put in the effort to create the habits to sustain this level of investing for almost 2 decades even when life throws you curve balls (which will happen)? Do you set aside time and energy to start a side hustle even when your friends are going out and having fun without you? Do you say “no” to the tug to spend more and that desire to show the world how successful you are by the clothes you wear or car you drive?

If you do, then the only thing between you and achieving that goal is…you.

A Different Cry:

Several years ago, I had a different moment while sitting down. This time, I was looking at my balance sheet and realized that I had surpassed my retirement number. There was no blubbering this time, just a calm lightness. I felt liberated. From then on, every day I walked into work was because it was my choice.

The funny thing? I realized I wanted to keep working because I was still having fun. For now. My 67 year old boss just retired. Instead of the joy and excitement you would’ve expected, he had a lot of fear about how he was going to fill the rest of his days. Do you want this fate? You work so hard for so long that when you do have financial freedom, you’re either too old or too set in your routine to experience all the things you used to want to do.

For someone working toward a single purpose for so long, it’s actually challenging to not have a big goal anymore. And the time to figure out what else to do is while you’re still employed. This is why I started Just Making Cents so that I could still have purpose and projects of my own choosing, and to have greater impact on people’s lives.

And that’s when life gets really fun.

Author bio: JT is passionate about viewing money differently, having spent over 15 years on Wall Street. He writes about money from the perspective of faith and as a father of 3 spunky kids.

Are you interested in learning how to retire early? Why or why not?

Leave a Reply