Is saving for retirement important? Some people think so. But, if you love spending all of your money on things you want right now, like lavish vacations and designer clothing, then maybe learning how to save money for retirement isn’t for you.

Just kidding, that’s horrible advice.

Your future is very important and you can significantly damage it if you are only thinking about the present.

Let me tell you again, saving for retirement is extremely important. If you keep putting it off, it’s only going to get harder, and it’ll most likely add a lot of stress to your life.

Even though prioritizing your future is important, the average person is behind when it comes to saving for retirement.

Saving for retirement now is important for many reasons, such as:

- It can help make sure you aren’t working for the rest of your life.

- You can retire sooner rather than later.

- You can lead a good life well after you finish working.

- Compound interest means the earlier you save the more you earn.

- You won’t have to rely on your children or others in order to survive.

As you can see, saving for retirement is very important.

However, according to a survey done by GoBankingRates, 56% of Americans have less than an average of $10,000 in retirement savings and 33% have no retirement savings at all.

This is a very scary statistic, and the image below illustrates is further.

Related:

- How To Become Financially Independent

- Early Retirement Myths Busted

- 15 Reasons You’re Broke And Can’t Save Money

- How To Come Up With A Financial Plan Without Visiting A Professional

Other interesting statistics found in this survey include:

- 42% of millennials have not begun saving for retirement.

- 52% of Gen Xers have less than $10,000 in retirement savings.

- About 30% of respondents age 55 and over have no retirement savings.

- 26% report retirement savings with balances under $50,000, an insufficient amount for people nearing retirement age.

- Nearly 75% of Americans over 40 are behind on saving for retirement.

These statistics terrify me.

And, it isn’t just young people without retirement savings, because as you can see around 30% of respondents age 55 and over have no retirement savings.

That is a lot of people who are close to or at retirement age with very little retirement savings!

So, why is this?

Why aren’t people saving for retirement?

They’re trusting ridiculous articles about not saving for retirement.

Sadly, there are many articles that say it’s okay to not save when you’re young.

However, you should never listen to a person telling you not to save money for retirement. Or perhaps, people are just agreeing with these ridiculous articles because it makes them feel better about how they aren’t saving for retirement?

Whatever the reason may be, everyone needs to face their fears and build their retirement savings.

I have read countless articles, such as If You Have Savings In Your 20s, You’re Doing Something Wrong, that tell people not to save money. I’ve even had people tell me that I’m not living the way I should because I’m saving for retirement.

I really hope no one is listening to this kind of advice, because there are so many reasons to start saving for retirement as early as you can. I don’t think I’ve ever heard someone say “I regret all that money I saved when I was younger.”

In fact, it’s usually the exact opposite.

You should start saving as much money as you can, as soon as you can, because it’ll help you be better prepared for the future.

Many people believe that 5% is enough to save.

There are a lot of people that think saving between 1% and 5% of their income is enough in order to be on track for retirement.

Sadly, that most likely won’t be enough to retire.

Instead, you should watch your spending now and/or find ways to make more money, so that you can start saving for retirement.

By spending less money, you’ll decrease the amount of money you need for the future, including money for emergency funds, retirement, and more.

Just think about it: If you are currently living a frugal lifestyle, then you will be used to living on less in the future. This means that your retirement savings doesn’t need to be as large, which means it may be easier to reach that savings goal.

According to the U.S. Bureau of Economic Analysis, the personal savings rate has averaged around 5% in the past year, and averaged 8.33% from 1959 until 2016.

While 5% is better than nothing, even just one small emergency each year could easily and completely wipe out that savings.

Further, saving just 5% means it will take you a very long time to retire. Mr. Money Mustache has a great graphic in his blog post The Shockingly Simple Math Behind Early Retirement that shows you how your savings rate can dramatically impact when you’ll retire. For example:

- With just a 5% savings rate, it would take you 66 working years until you reached retirement.

- A 25% savings rate means that it would take you 32 working years to retire.

- A 50% savings rate means that it would take you 17 working years to retire.

- A 75% savings rate means that it would take you 7 working years to retire.

So, by saving more of your money, you are likely to retire sooner. Sounds amazing, right?

Related: Do You Know Your Net Worth?

A lot of people don’t understand compound interest.

Saving for retirement as soon as you can is a great thing, especially because of the power of compound interest.

With compound interest, time is on your side- meaning you should start saving money as early as you can.

Compound interest is when your interest is earning interest. This can turn the amount of money you have saved into a much larger amount years later.

This is important to note because $100 today will not be worth $100 in the future if you just let it sit under a mattress or in a checking account. However, if you invest through your retirement account, then you can actually turn your $100 into something more. When you invest, your money is working for you and growing your savings.

For example: If you put $1,000 into a retirement account with an annual 8% return, 40 years later you will have $21,724. If you started with that same $1,000 and put an extra $1,000 in it for the next 40 years at an annual 8% return, that would then turn into $301,505. If you started with $10,000 and put an extra $10,000 in it for the next 40 years at an annual 8% return, that would grow into $3,015,055.

Side note: I recommend you check out Empower (formally known as Personal Capital) if you are interested in gaining control of your financial situation. Personal Capital is similar to Mint.com, but much better. Personal Capital is free and it allows you to aggregate your financial accounts so that you can easily see your whole financial situation, including investments.

Some think it’s normal to not have retirement savings.

Many people normalize their debt or low savings rate (or even lack thereof) because they assume others aren’t doing so well either.

Well, why would you want to be normal, especially when it comes to saving money?

You should always strive to do your best as sometimes “average” is not good enough for you to live a financially successful life. Keep in mind that the average person is not the greatest with money, and many are wrecked with stress and hardship due to their unfortunate financial situation.

Just because the average person has a low average savings amount doesn’t mean that you have to be in that same financial situation. Instead, you should be in control of your own life!

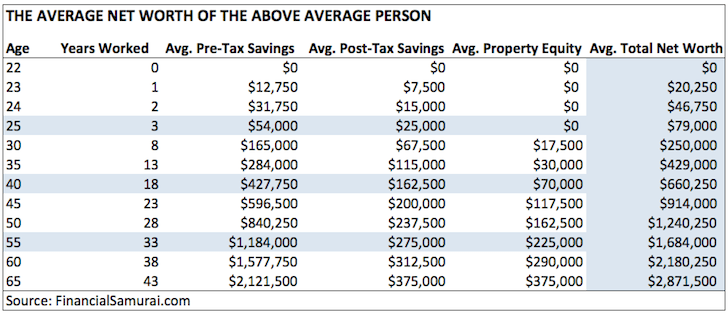

If you want to be even better than the average, I highly recommend reading The Average Net Worth For The Above Average Person on the Financial Samurai website. It is an excellent article that can motivate you to improve your finances.

According to Financial Samurai, the average net worth of the above average person is:

Remember, striving to be above average means you can take control of your financial situation, retire on time or even early, and live a happier life.

People think that saving for retirement means you won’t have fun.

As you all know, I really dislike the myth that people who save money are boring. That’s not true at all.

I believe that you can find a balance while living a good life and saving a comfortable amount of money.

There are plenty of ways to live an awesome life while saving money and budgeting realistically. Yes, you can still see your friends, have fun with your loved ones, go on vacations, and more.

Here’s a list of some early retirees who are leading great lives. I definitely recommend reading about them:

If you want to learn how to save for retirement, then learning how to be happy with yourself and figuring out affordable ways to enjoy life are key.

Related article: How To Have Frugal Fun

Women are 27% more likely than men to have no retirement savings.

In fact, 63% of women say they have less than $10,000 saved for retirement to NO savings for retirement at all, which compares to 52% of men in the same situation.

To change this money statistic, please read The Smart Woman’s Guide To Investing Success. Here’s a quick snippet from that blog post:

“Women face different obstacles than men do when it comes to investing in the stock market. Right off the bat, they tend to have less in savings because women often take time off to raise children. With years of not earning a salary, there is no money being saved and compounded upon.

In addition to this, women typically outlive men by close to 10 years on average. Therefore, it is important as a woman to invest in the stock market.”

Some people think they don’t need to save yet.

Instead of thinking that you’re invincible and that you have all the time in the world to improve your finances, you should stop procrastinating and learn how to build your wealth now.

Many people push things off and/or spend their money carelessly because they think they can start tomorrow, next month, and so on. However, for everyday that you push off saving for retirement, the further away and harder you’ll have to work towards your goal.

Stop wasting time and take control of your financial situation now.

Read Why Saving Money In Your 20s Is A Good Idea to learn more.

Many think their income will never end.

Yes, there are many different types of jobs and your income potential is pretty much unlimited. However, you never know how long you’ll be making money, whether you’ll come across medical issues, or how long your job will last.

You might be thinking “But I enjoy my job!”

While it’s great to love your job, you should still be saving for retirement. I have heard far too many people say they don’t need to build their retirement savings account because they love their job enough to just work forever and still be happy.

However, what happens when you can no longer work? You don’t know what the future will bring. You may encounter a medical problem, a serious life event, you may hate your job 20 years from now, and so on.

Remember, nothing is guaranteed.

So, instead of spending every last penny, you should find ways to start saving for retirement.

What you need to do to jump start saving for retirement.

The sooner you start saving, the sooner it will become a habit. By saving for retirement now, you will learn good retirement savings practices that will help you well into the future.

I always say that the first step to investing is to just jump in. However, what if you don’t even know how to start investing and saving for retirement?

If you are like many who don’t know how to begin, here are the easy steps to start saving for retirement:

- Start saving your money. In order to invest your money, you need to start setting aside money specifically for it. The amount of money you save for investing is entirely up to you, but in general, the more the better.

- Do your research. Before you start dumping your money into the stock market and other investments, it’s a good idea to know what you’re putting your money towards. Researching various investment-related tips will help you become more informed about your investing decisions, which only means you will make better decisions well into the future.

- Find an online brokerage or someone to manage your investments. There are two main ways to invest your money- yourself through a brokerage or you can find someone to manage your investment portfolio for you. You will need to chose one of these options to actually start investing your money. Personally, I like to do everything myself through Vanguard.

- Decide how you will invest. How you invest depends on your risk tolerance, the time period for which you are investing (when will you retire?), and more. Generally, the sooner you need your funds the less risk you will take on, whereas the longer your time period is, then the more risk you may be willing to take.

- Track your investment portfolio. This is important because you may eventually have to change what you are invested in, put more money towards your investments, and so on.

- Continue the steps above over and over again. To invest for years and years to come, you will want to continue the steps above over and over again. Now that you know the steps it takes to invest your money, it only gets easier.

As you can see, saving for retirement isn’t impossible. By starting now, you’ll set yourself up for a much better future.

Have you started saving for retirement? Why or why not?

Leave a Reply