Yes, you just read the title of this blog post correctly. My student loans are gone and fully paid off!

Donezo. Eliminated. Demolished.

It seems like just a couple of months ago I published my post about my $38,000 in student loans (scroll down to the bottom of this post if you are interested in how I paid off my student loans) and how badly I wanted them gone.

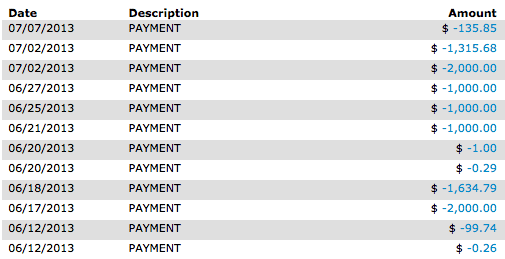

I have made a decent amount of recent payments and have watched our savings account dwindle down to a very low and uncomfortable number (still livable though).

Our monthly income keeps increasing and without it, none of this would have been possible. I am very grateful for everything in life.

Also, many have asked about why I made some small payments of less than $1 (see the picture below). It is because whenever I would pay the full amount of the loan off, they would still charge interest on the loan for the day until the actual payment was received. So, I had some small payments of less than $1.

Related blog posts on how to pay off student loans quickly:

- 30+ Ways To Save Thousands of Dollars Each Month

- How To Work From Home By Selling on Amazon

- 75+ Ways To Make Extra Money

- How Do Student Loans Work?

My Student Loans

I worked full-time all throughout my undergraduate and graduate degrees, and still managed to have student loans. I’m going to blame it on the fact that I had to move out when I was 17/18 and I had to pay for myself to live, but honestly, I wasted a lot of the money I made as well.

I spent tons of money on clothes and food. Wes and I were not the smartest with money when we were younger and first moved in together. I will be honest and say that.

The total amount of student loans that I accumulated was around $40,000 after I received both my undergraduate and graduate degrees. You can read more about my degrees in the post How I Graduated From College In 2.5 Years With 2 Degrees AND Saved $37,500.

We have had some of the money saved in our emergency fund for quite some time, but I had a hard time parting with it. That is the main reason for why I was able to throw such large payments at my loans every week, and especially the last couple of weeks when I had student loan debt.

Some people ask me if I regret my degrees now that I will be switching to being a full-time blogger. No, I still don’t regret going to school even now that I plan on switching to 100% freelancing. I don’t think I would be where I am today without my degrees, and I do think that they will continue to help me into the future.

My original goal was to finish paying off my student loans in March of April of this year, but I fell a few months behind.

We definitely did some unnecessary (but fun spending), which caused us to be a little behind schedule. However, I’m not going to complain, I’m super proud of myself! I thought that my goal seemed a little hard, and it was, but I only fell a couple of months behind, so it definitely wasn’t impossible.

My Financial Future

What will we do with the additional income that we make every month now that $5,000 to $10,000 isn’t going towards student loans? We’re still not sure! Having this kind of cash flow will be very different from what we are used to because for such a long time everything has been going to my student loan debt.

We definitely want to save as much as we can in order to build a large enough emergency fund to prepare us for the freelancing life that I will be entering.

We also want to start investing more aggressively starting this month. We’ve always invested a little, but not enough as to where it’s a meaningful accomplishment relative to me paying off my students loans.

We still don’t know when we will be buying our next house, and lately we have been talking about putting it off for a couple more years. We haven’t lived in our current home for very long (4 years), and it still fits us for now. So we will be saving for our next house down payment fund, but at the moment it’s not at the very top of our list.

Now, I do realize that in a couple of months that we won’t still have this huge savings amount every month since I will be eliminating an income source. Our income and, therefore, our amount of savings per month will decrease significantly, and that is something that will take getting used to. It’s all relative, though. Just one year ago, I could have never dreamed of being anywhere near half of what we make today. It’s only normal that I can’t work 2 full-time jobs forever.

Anyway, I am so excited that my student loans are gone! And yes, this is a bragging post 🙂

Here are my tips to pay off your student loans quickly:

Here are my tips to pay off your student loans quickly:

Do you know how much student loan debt you have?

The first thing that made me jumpstart my student loan repayment plan was the fact that I took the time to add up how much student loan debt I had.

It shocked me so much that I wanted to throw up. That’s good though because it can be a good source of motivation for most people.

I know it was for me!

When you add up your student loans, do not just take a guess. Actually pull up each student loan and tally everything down to the exact penny.

Understand your student loans.

There are many people out there who do not fully understand their student loans. There are many things you should do your research on so that you can create the best student loan repayment plan.

This mainly includes:

- Your interest rate. Some student loans have fixed interest rates, whereas others might have variable rates. You’ll want to figure out what the interest rate on your loans are because that may impact the student loan repayment plan you decide on. For example, you might choose to pay off your student loans that have the highest interest rates first so that you can pay less money over time.

- Student loan reimbursements. Some employers will give you money to put towards your student loans, but you should always do your research when it comes to this area. Some employers will require that you work for them for a certain amount of time, you have great grades, good attendance, and they might have other requirements as well. There are many employers out there who will pay your student loans back (fully or partially), so definitely look into this option.

- Auto-payments. For most student loans, you can probably auto-pay them and receive a discount. Always look into this as you may be able to lower your interest rate by 0.25% on each of your student loans.

I recommend that you check out Empower (a free service) if you are interested in gaining control of your financial situation. Empower allows you to aggregate your financial accounts so that you can easily see your financial situation, your cash flow, detailed graphs, and more. You can connect accounts such as your mortgage, bank accounts, credit card accounts, investment accounts, retirement accounts, and more, and it’s FREE.

Create a budget.

If you don’t have one already, then you should create a budget immediately.

First, include your actual income and expenses for each month. This will help show you how much money you have left over each month and how much money should be going towards your student loan debt each month.

Earn more money.

The month I paid off my student loans was a month where I earned over $11,000 in extra income. While this does sound crazy, I did start off by making just $0 in extra income. Everyone has to start somewhere.

Even if $11,000 a month isn’t possible for you, I’m sure something is. If you can make an extra $1,000 a month in extra income, that can help you knock out your student loans in no time.

Some ways to make extra money are below, but check out the related articles below to see many, many more:

- Start a blog. Blogging is how I make a living and just a few years ago I never thought it would be possible. As of December of 2016, I am now earning around $100,000 a month blogging and I never thought this would be possible. You can create your own blog here with my easy-to-use tutorial. You can start your blog for as low as $2.95 per month plus you get a free domain if you sign-up through my tutorial.

- Sell your stuff. There are many things you can do to make money by selling items. We all have extra things laying around that can be sold, or you can even search for items that can be bought and resold for a profit.

- Answer surveys. Survey companies I recommend include Swagbucks, American Consumer Opinion, Survey Junkie, Pinecone Research, Opinion Outpost, Prize Rebel, and Harris Poll Online. They’re free to join and free to use! You get paid to answer surveys and to test products. It’s best to sign up for as many as you can as that way you can receive the most surveys and make the most money.

- Rent an extra room in your home. If you have extra space in your home, then you may want to rent it out. Read A Complete Guide To Renting A Room For Extra Money.

- Try InboxDollars. InboxDollars is an online rewards website I recommend. You can earn cash by taking surveys, playing games, shopping online, searching the web, redeeming grocery coupons, and more. Also, by signing up through my link, you will receive $5.00 for free just for signing up!

- Find a part-time job. There are many part-time jobs that you may be able to find. You can find a job on sites such as Snagajob, Craigslist (yes, I’ve found a legitimate job through there before), Monster, and so on.

Related articles:

- 75+ Ways To Make Extra Money

- 8 Things To Sell To Make Money

- 10 Ways To Make Money Online From The Comfort of Your Home

- 10 Things I’ve Done To Make Extra Money

- Ways To Make An Extra $1,000 A Month

Cut your expenses.

The next step is to cut your budget so that you can have a better student loan repayment plan. Even though you may have just created a budget, you should go through it line by line and see what you really do not need to be spending money on.

There’s probably SOMETHING that can be cut.

You might not have even realized it until after you wrote down exactly how much money you were shoveling towards nonsense until now. However, now is better than never!

We worked towards cutting our budget as much as we could. I can’t remember exactly how much we cut it by, but I know that it was enough to where I felt like I was putting a dent in my student loans.

Even if all you can cut is $100 each month, that is much better than nothing. That’s $1,200 a year right there!

Some expenses you can lower or ways to save money include the below:

- Earn free cash back. Sign up for a website like Ebates where you can earn CASH BACK for just spending like how you normally would online. The service is free too! Plus, when you sign up through my link, you also receive a free $10!

- Lower your cell phone bill. Instead of paying the $150 or more that you spend on your cell phone bill, there are companies out there like Republic Wireless that offer cell phone service starting at $10. YES, I SAID $10! If you use my Republic Wireless affiliate link, you can change your life and start saving thousands of dollars a year on your cell phone service. I created a full review on Republic Wireless as well if you are interested in hearing more. I’ve been using them for over a year and they are great.

- ATM fees. Why do people do this to themselves?

- Pay bills on time. This way you can avoid late fees.

- Shop around for insurance. This includes health insurance, car insurance, life insurance, home insurance and so on. Insurance pricing can vary significantly from one company to the next. When we were shopping for car insurance last, we found that our old company wanted something like $205 to insure one car for one month, whereas the new company we have now charges $50 a month for the same exact coverage. INSANE!

- Save money on food. I recently joined $5 Meal Plan in order to help me eat at home more and cut my food spending. It’s only $5 a month (the first four weeks are free too) and you get meal plans sent straight to you along with the exact shopping list you need in order to create the meals. Each meal costs around $2 per person or less. This allows you to save time because you won’t have to meal plan anymore, and it will save you money as well!

- Fuel savings. Combine your car trips, drive more efficiently, get a fuel efficient car, etc.

- Trade in your car for a cheaper one. For us, we are car people. Cars are one of our splurges. However, if you only have a nice car to keep up with the Joneses, then you might want to get rid of it and get something that makes more sense.

- Live in a cheaper home. I’m not saying you need to go live in a box, but if you live in a McMansion then you may want to think about a smaller home. This way you can save money on utility bills and your mortgage payment.

- Learn to have more frugal fun. We don’t spend anywhere near the same amount of money on entertainment as we used to. There are plenty of ways to have frugal fun.

Pay more than the minimum.

The point of all of the above is to help you pay off your student loans. However, you can always go a little bit further and pay off your student loans more quickly. The key to this is that you will need to pay more than the minimum each month for you to speed up your student loan repayment plan process.

It may sound hard, but it really doesn’t have to be. Whatever extra you can afford, you should think about putting it towards your student loans. You may be able to shave years off your student loans!

How much student loan debt do you have? What’s your student loan repayment plan?

Here are my tips to pay off your student loans quickly:

Here are my tips to pay off your student loans quickly:

Leave a Reply