The following is a sponsored partnership with SafetyWing travel medical insurance. All opinions are 100% mine.

I have been traveling full-time for several years now.

While before it was mainly in the US by RV, and due to laziness, I had never looked into travel medical insurance.

I just always thought that I was fine.

Almost invincible – like nothing bad would happen to me while traveling!

However, lately, I have been hearing horror stories from friends, of those who travel and have had accidents and/or medical emergencies while traveling. Due to that, I recently started looking into the best travel medical insurance.

We are about to leave the U.S. on our sailboat, and travel health insurance is something that we desperately need.

I realize that we have been lucky in the past that nothing medical-wise has popped up for us. Due to that, I don’t want to wait any longer and finally get something to help protect us in case a medical emergency does arise.

Many people simply skip over travel medical insurance. You may have simply thought that you did not need it, or you may not even realize that it exists. Or, you may believe that your current health insurance will cover you while traveling.

You may not have even ever thought about getting travel medical insurance before.

If you’ve bought a flight in the past online, you may have noticed an option to purchase trip insurance at the same checkout time. However, you may have not encountered travel medical insurance before. These are two completely different types of coverage, so please continue to read.

Trip insurance, such as what is offered when you buy an airline ticket may cover what happens during your actual transport, such as flight changes or cancellations, losing your suitcase, and so on. But, travel medical insurance is for any medical situations that you may find yourself in while you are traveling.

So, if you’re a digital nomad, travel full-time, travel long-term, or if you simply travel at all, then travel insurance is definitely something that you should be looking further into.

What’s a good travel medical insurance company?

Now, you are probably wondering where you can find good travel insurance.

If you are looking for travel medical insurance, then I recommend looking into SafetyWing.

SafetyWing is travel medical insurance for those who travel long-term.

So, if you RV, van, boat, fly, backpack, etc. then you may find this extremely helpful and beneficial for you and your situation.

Before you click out of this, it is actually quite affordable too! I was super surprised when I saw the pricing of their travel medical insurance, along with everything that it includes.

At only $37 per four weeks for those between the ages of 18 to 39, you can receive worldwide travel medical coverage from SafetyWing, for a $250,000 maximum limit. There are other age groups allowed too, of course, for a slightly higher rate.

How does this pricing compare to other travel medical insurance companies? This price is about one-third of the price compared to other companies who offer similar coverage.

You can also purchase their travel medical insurance when in 180 different countries. Many travel insurance companies require you to purchase their insurance before you leave your home country, but with SafetyWing, you can purchase it when you are already traveling, almost in anywhere in the world (exclusions include Cuba and North Korea).

You can also choose your start date for your insurance, and it will automatically extend until you cancel, or you can choose an end-date as well. There is also no cap on how long you can travel and be insured. This is super useful if you travel long-term! When I was looking for travel medical insurance, it was difficult to find one that covered me as a full-time traveler. There were many clauses that excluded people like me!

As you can see, SafetyWing insurance was created to meet the needs of business owners and remote workers who are traveling and/or living abroad around the world. They include both trip and travel medical insurance in one, which is great.

SafetyWing insurance includes:

- Travel medical insurance – You can access a qualified global network of hospitals and doctors for unexpected medical problems and accidents. This includes coverage for: doctors, hospitals, and emergency medical evacuation.

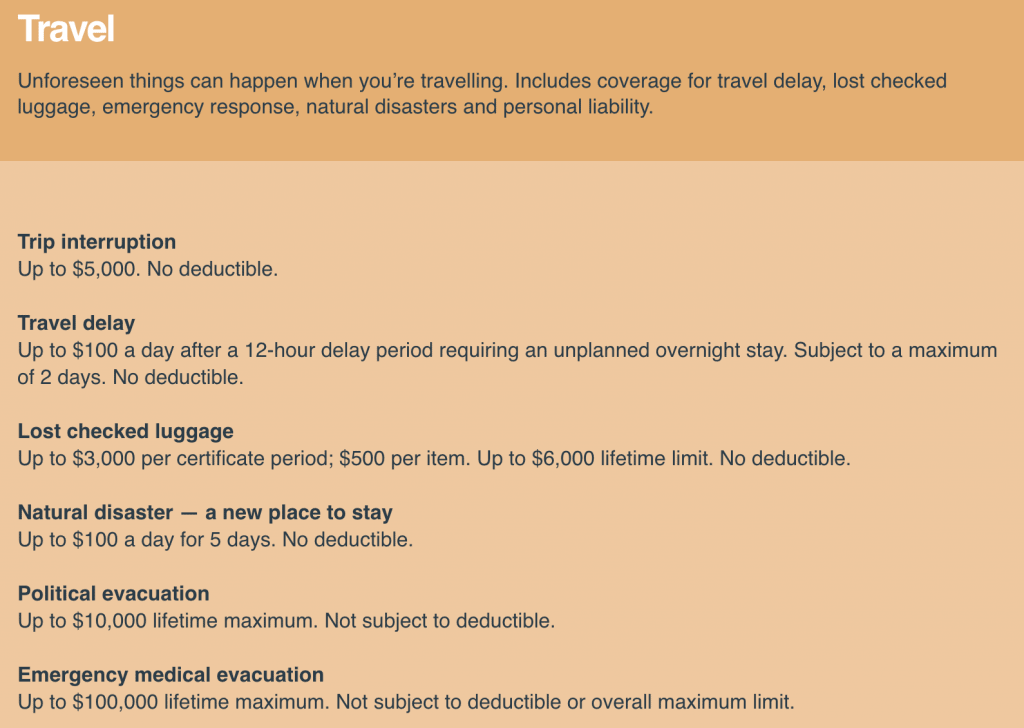

- Trip insurance – This includes coverage for: travel delay, lost checked luggage, emergency response & natural disasters, and personal liability.

To add to the value even more, if you are a traveling with children, then one young child per adult (up to two per family) between 14 days old and 10 years old can be included on your SafetyWing insurance plan without paying anything extra. I know there are plenty of families who travel long-term, so this is a nice added extra to help you save more money.

So, what does SafetyWing cover when it comes to travel or medical expenses?

You can see examples below of what is covered through SafetyWing insurance (screenshots taken from their website):

Note: I do want to note that of the notable exclusions above, high-risk sports is truly high-risk ones. For example, sports that are included under SafetyWing include biking, bungee jumping, camping, hiking, sailing, wakeboarding, and more. High-risk sports activities that are excluded from SafetyWing’s insurance are those such as base jumping, heli-skiing, and running with the bulls. Other notes include that SafetyWing’s insurance provides this coverage for those traveling outside their home country, while it will cover those traveling inside the U.S. but only for a limited amount of days. It does not cover routine checkups and preventative care.

SafetyWing is reliable too – the policy is administered by Tokio Marine which is one of the largest insurance companies in the world. The policy is underwritten by certain underwriters at Lloyds. Claims are handled by Tokio Marine directly, who offer 24/7 support when a person is in need. This is especially important when you are talking about travel medical insurance, as accidents can happen at anytime and timezones are different all over the world.

As you can see, SafetyWing’s insurance is super valuable, and at an affordable price point. If you do not have travel medical insurance yet, there is really no reason not to.

At just $37 a month, SafetyWing is a no-brainer for those who travel long-term.

Please click here to check out SafetyWing travel medical insurance.

SafetyWing affiliate program

Also, I do want to mention that SafetyWing has an affiliate program. So, if you have a social media, email, or blog presence, then you may want to look into promoting them as well.

Many people travel without any sort of medical insurance that will cover them outside of their area. So, the more people that can hear about travel medical insurance, the better that everyone can be prepared.

And, if you travel long-term, I’m sure someone has asked you “What are you doing for insurance?” at least one time. If that’s the case, then you can finally refer them to something helpful!

I get asked this at least a few times a week, and before I would usually just brush off the question because it was not something that I had looked into or thought that applied to me.

After researching SafetyWing and travel medical insurance, I became an affiliate, and that is why I’m publishing this review.

It’s super easy to become an affiliate for SafetyWing. Here are the steps:

- Fill out this Google Form

- Someone from the SafetyWing team will personally reach out to help you create a user account

- Once you have completed the quick and simple affiliate activation process, you will be directed into your affiliate dashboard, where you can see your affiliate marketing platform analytics.

Do you have travel medical insurance? Why or why not?

Leave a Reply