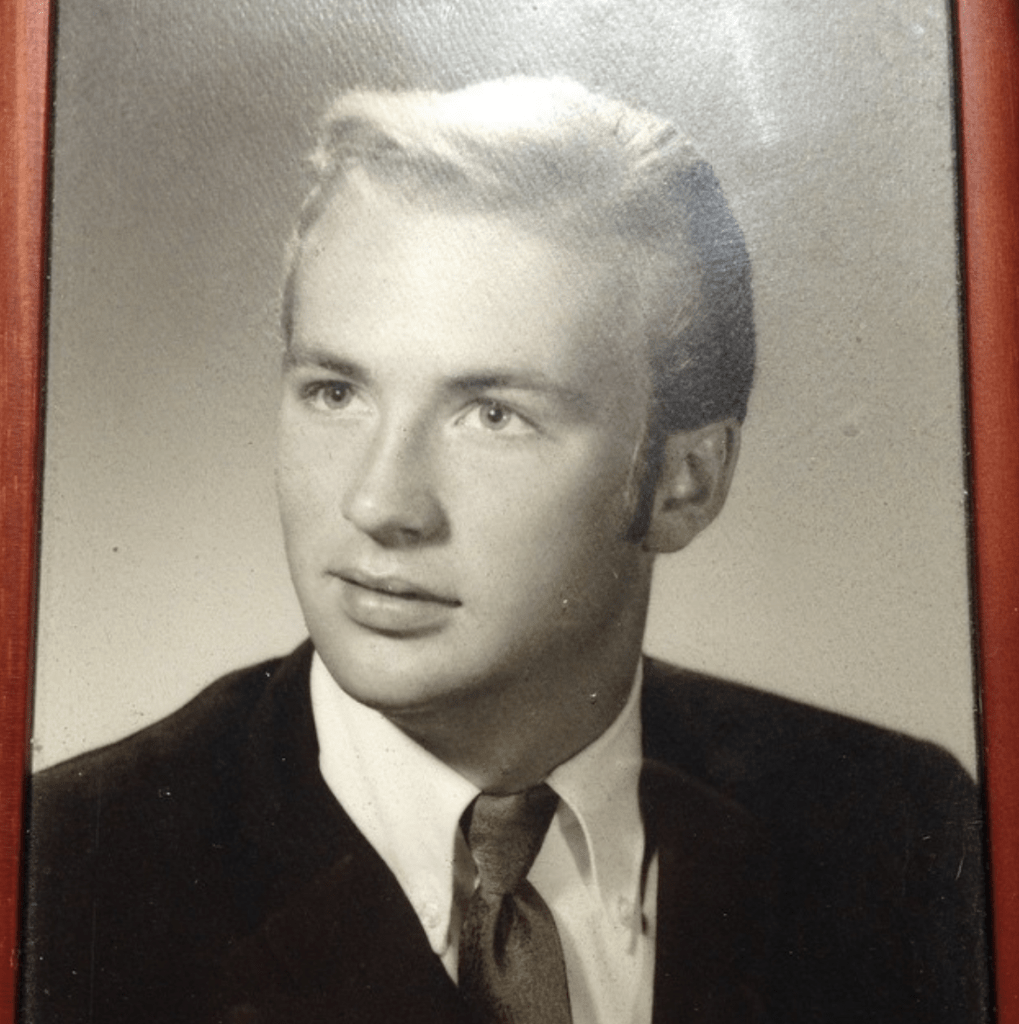

On April 18, 2008, my father passed away from cancer. It’s always a sad day to remember, but as each year passes, I strive to honor him by making each day better than the last. I know that’s what he would have wanted, and I would like to dedicate today’s post to him. I wrote this blog post years ago, but I have updated it for this year, and it still makes me very happy when I read it and think about him. Enjoy!

Hardly a day goes by when I don’t think of my dad. The littlest thing will remind me of him, and I am both sad and grateful when that happens.

My dad was a huge part of my life, and it only makes sense to talk about him today. This is especially true because he taught me so many important financial lessons that have helped me become the person I am today.

If it weren’t for my dad, I would probably be, at least, a little worse with money. I think I’d probably be a little worse at a lot of things if it weren’t for him.

I didn’t really think about the financial lessons he taught me when I was younger, but I’m so glad that I was able to learn so many valuable things from him. To this day, I still remember little things he shared and taught me, and they help me to keep learning more from him. It’s a crazy feeling to keep remembering things even though it’s been years since he’s passed.

Due to this, I believe that teaching your children valuable financial lessons is key. My dad did tell me things about money, but the best lessons came from watching the way he managed his money while living the life he wanted. Teaching your children about money will help them grow up and be better able to manage a budget, understand investing, know how to save money, and more. I know this from personal experience.

Below are some of the many great financial lessons my father taught me.

My Dad taught me that I could afford to travel.

One of the biggest financial lessons my father taught me was that I can afford to travel.

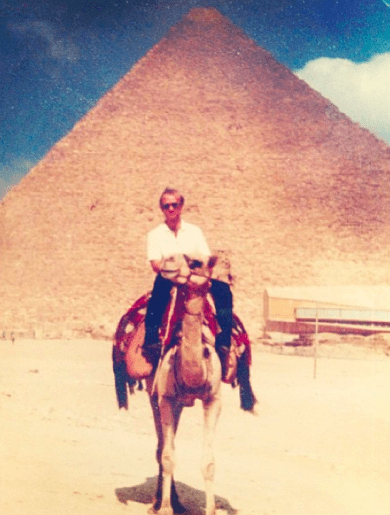

Besides his family, the other things my dad loved in life were traveling and airplanes (he had his pilot’s license and worked for the airlines nearly his whole life – so my recent April Fools joke, We’re Moving Onto A Plane!, actually fooled quite a few people because they knew this fact about him). He traveled all over the world and always made sure to fit traveling into his life in any way he could, and I gained many great memories from it.

I still remember him taking me to Disney World ALL THE TIME (I loved it!). He flew us in small planes, and I even had a great time just sitting at the airport. I’m one of those weirdos who genuinely loves being at the airport.

My Dad loved every single part of traveling, and he passed that on to me.

He created hundreds of photo albums from his travels, which I still look at on a regular basis. I also recently found a travel journal he kept that listed all of the amazing places he traveled to.

If you are thinking my dad was rich, he wasn’t. Instead, he worked with his budget and found ways to fit exciting trips in because travel was important to him. This meant that he probably went with less than some people think is possible, when he actually gained much more by budgeting for travel.

We didn’t live in a huge house or have fancy things. In fact, we grew up living in small, cheap apartments because he absolutely hated yard work and maintaining a home, so he liked apartment life because it meant that a landlord took care of all of that.

He bought a new Camaro in 1984 (this was his baby), and he drove it up until a few months before he passed away in 2008. He didn’t care about furniture, electronics, or anything else. He would often work long hours, he never ever called off work, he always had a budget, he always saved money, and more.

He was all about travel, and he managed his money well enough to be able to take trips whenever he could.

He taught me that you don’t need to spend tons of money on material things.

My dad was extremely frugal. He hardly ever went shopping for himself, other than for things such as new work shoes (that’s literally all I can remember him buying for himself, and they were from Kmart).

My dad always dressed nice, slacks with a nice sweater or shirt. In fact, he had the same exact wardrobe the whole entire time I knew him (I’m not even kidding – it was literally the same clothing). He didn’t own a single pair of jeans, a single T-shirt, or anything else like that.

He spent very little money on clothing and that leads to my next thing –

My dad wasted almost nothing. He probably did not realize it at the time, but my dad was a champion of the eco-friendly movement.

He wore shirts until they disintegrated, he loved finding furniture on the side of the road (it still makes me laugh to think about the way our living room looked – a hodgepodge of random street finds), and he hardly ever wasted anything.

When I was a kid, I was embarrassed by the way our home looked, but now I completely understand.

My dad didn’t value decor or material things, he valued experiences.

He taught me not to live paycheck to paycheck.

My dad was all about having a budget. He went over his budget and his checkbook nearly every single day. Working for the airlines meant that he occasionally got laid off and rehired over and over again.

Due to this, he always made sure to budget his money well.

He always had an emergency fund, spent less money than he made, and always made sure to put as much money as he could towards retirement.

My dad did anything and everything to make sure that we didn’t have to worry about money or go without anything that we needed when we were kids. It’s a trait of his that I loved. Even when he would get laid off, he never acted like it was a big deal because he was always prepared.

He taught me that credit can be used to my advantage.

The topic of credit cards and credit came up a lot when I was younger.

I remember one day being with my dad and seeing what I thought was a scammy credit card commercial. I was super young and said, “I’m never going to have a credit card!”

My dad told me that if I used them correctly, credit cards could be used to my advantage. Even though I was young, he then explained how to use credit cards, and I now use them on a regular basis to earn awesome rewards and bonuses.

Thanks Dad for another great money lesson!

My dad taught me that money doesn’t have to limit you.

Out of all of the money lessons he taught me, this last one is probably the most important.

Even though my dad passed away too young, lived on a budget, and saved for a retirement that he never got to experience, I truly believe that he was still able to live life the way he wanted to. When he was told that he had limited days left to live, he never once dwelled on the past nor did he say that he wished he would have done something different in order to live a better life.

He was able to travel all over the world and visited many, many countries. I’m not sure how many countries he visited but I know it was well over 50.

I think the most important money lesson I learned from my father is that money doesn’t have to control you. Even though you will never know when your last day is, you can still save and spend your money wisely, while also living the life you want.

Too many people believe that they can’t lead a good life on a budget. But, that is not true at all. You can still live a great life while managing your money and living without regret.

What financial lessons did your parents teach you? What financial lessons will you make sure you teach your children?

Leave a Reply