Today, I am sharing my FreshBooks review with you. This article is sponsored by FreshBooks but is 100% my opinion.

Today, I am sharing my FreshBooks review with you. This article is sponsored by FreshBooks but is 100% my opinion.

A common question I receive is what I use for my small business accounting. If you are looking for a great software to use for your small business (such as for an online business, a blog, your virtual assistant career, etc.), I recommend looking into FreshBooks.

I’ve been using FreshBooks for a couple of years now, and it’s been my favorite. Their software makes it extremely easy to manage my business and to create invoices.

Now, if you haven’t heard of FreshBooks, they have been featured in Forbes, CNN, The New York Times, Mashable, Bloomberg, and more.

As a small business owner, tax time and keeping track of my income and expenses isn’t exactly the most fun part of having a business. I always say that the most un-fun part of running a business of your own is when it comes to tax time.

However, it is an absolute must to have your tax and accounting situation handled correctly.

Seriously, there is no other way around it. You need to file your taxes every year, and you should have the best possible system of doing so.

I’m sure that for a new business owner, that this can sound scary and even overwhelming. However, it’s not! It’s actually quite simple. It’s all about correctly logging everything, and a simple accounting software can help you do this easily.

I’ve always taken tax time and accounting seriously with my blogging business, as I used to be a financial analyst and worked with various businesses. This always seemed to be a business’ biggest mistake – managing their books incorrectly.

Or, sometimes a business would skip this altogether and it would just be a huge mess!

You need to have a good accounting system, as this makes running a business much easier and less complicated. Plus, at tax time, you won’t be scrambling to gather all of your documents and you will be less likely to make a costly mistake.

Without a good accounting software, then you may make big errors, such as recording too little income, forgetting expenses, pay more in taxes, and so on. Being organized with your business’ finances is always better than being unorganized. In fact, I’ve never met a person who has said “I’m glad I have NO accounting system for my business!”

It’s usually the exact opposite. Having a good accounting software and system for your business can help your sanity.

Here’s why I like using FreshBooks.

The many beneficial features of FreshBooks.

I’ve been using FreshBooks for years and don’t plan on switching to anything else. With FreshBooks, you can:

- Create invoices for clients. They are professional looking and very easy to create.

- See when your client has seen your invoice, and put an end to the guessing games. This is one of my favorite features, because then I can easily know whether or not it has been received, and what’s going on with the invoice.

- Easily record your business expenses

- Track your time – If you are freelancing for someone and need to track the amount of time you spent on a project, FreshBooks can do that for you.

- Set up online payments with just a couple of clicks and get paid up to 4 days faster

- Accept credit card payments

- See business performance reports (such as a Profit and Loss Report, Payments Collected Report, Expense Report, etc.), which will make tax time much more simple!

- Manage your accounting needs from your cell phone. FreshBooks has a mobile app so that you can create invoices, record receipts, manage expenses, and more all from wherever you are.

And, best of all, it’s super easy to use.

Please click here to try FreshBooks for free for 30 days.

FreshBooks invoicing.

One of my most favorite things about FreshBooks is how easily I can create an invoice for a client.

If you have a small business, then you are probably at least occasionally creating invoices. For me, I may create an invoice for an affiliate client, for almost all sponsored post clients, and more.

FreshBooks makes it super easy to make an invoice, and they are professional looking as well.

Some other benefits of the FreshBooks invoicing system include:

- You can invoice from anywhere with the mobile app

- You can accept payment via credit card on your FreshBooks invoices

- You can automate reminders so that you can send friendly reminders to your clients about paying the invoice

- You can request a deposit through an invoice, so that you can get paid upfront before starting a project

- You can easily add your tracked time and expenses to your invoices with FreshBooks

- Add invoice due dates

- Customize invoice payment term

- Easily offer discounts to your clients

- You can send recurring invoices. So, if you invoice the same amount on a set schedule, FreshBooks automates everything from making invoices to collecting payments and even reminding any late-paying customers.

And more!

You can learn more about FreshBooks’ invoices here.

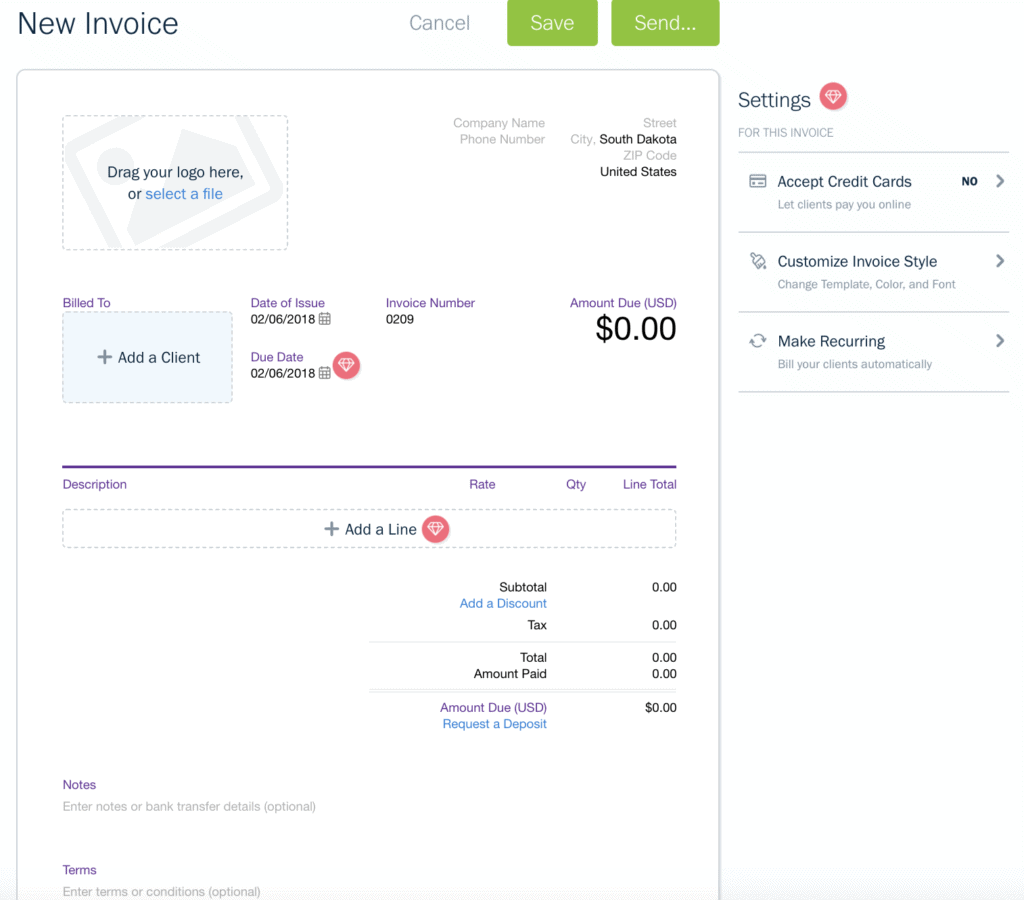

So, how do I create an invoice?

Since one of my favorite things to use FreshBooks for is to easily create invoices, I want to show you how to make one with their small business accounting software.

First, you’ll need to sign up. You can get started for free for 30 days by clicking here.

Then, head to your dashboard and on the left-hand side, click on “Clients.”

If you don’t have any clients yet in FreshBooks, then you will want to add a new client. You can enter their first name, last name, their email address, phone number, address, and whatever else you want to add. You don’t need all of that information, of course, just whatever you need to actually send them the invoice.

Then, you’ll save that client and click on “Invoices” on the left-hand side. Click the “New Invoice” button.

Then, you’ll be brought to this:

This is where you can easily go in and make an invoice. You can add a logo, choose which client you’ll send the invoice to, the date, the due date, the amount due, and more.

You can then choose to either send the invoice directly through FreshBooks to the client, or you can save it as a PDF and send it to them manually – whichever way you prefer.

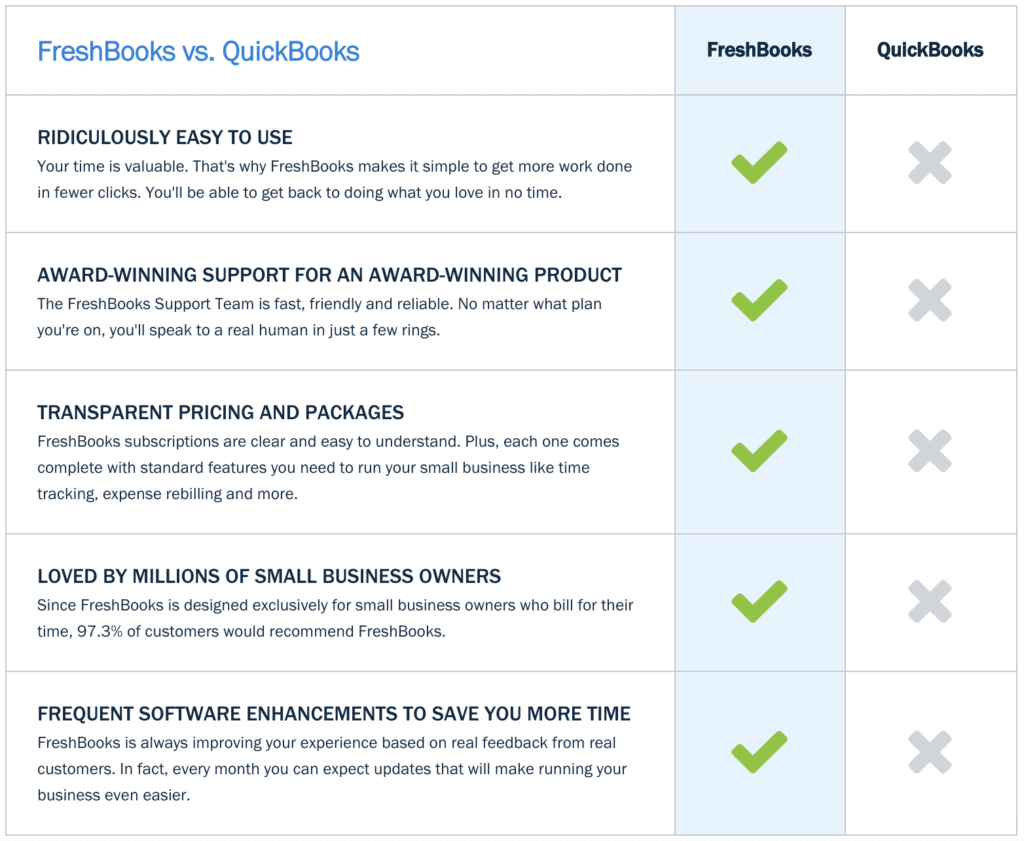

How does FreshBooks compare to other accounting software?

So, you are probably wondering how FreshBooks compares to other small business accounting software.

FreshBooks is the only cloud accounting software that is designed for small business owners.FreshBooks has over 10,000,000 small business users.

Below is a great chart that easily compares FreshBooks versus Quickbooks for you.

How much does it cost to use FreshBooks?

FreshBooks is quite affordable. They have plans starting at just $15 a month. If you have many clients, such as 50, then it goes up to $25 a month. They also have yearly plans that can save you money.

You can check out all of FreshBooks’ pricing plans here.

What do you use for your accounting needs for your business?

How To Start A Blog Free Email Course

Want to see how I built a $5,000,000 blog?

In this free course, I show you how to create a blog, from the technical side all the way to earning your first income and attracting readers. Join now!

Leave a Reply