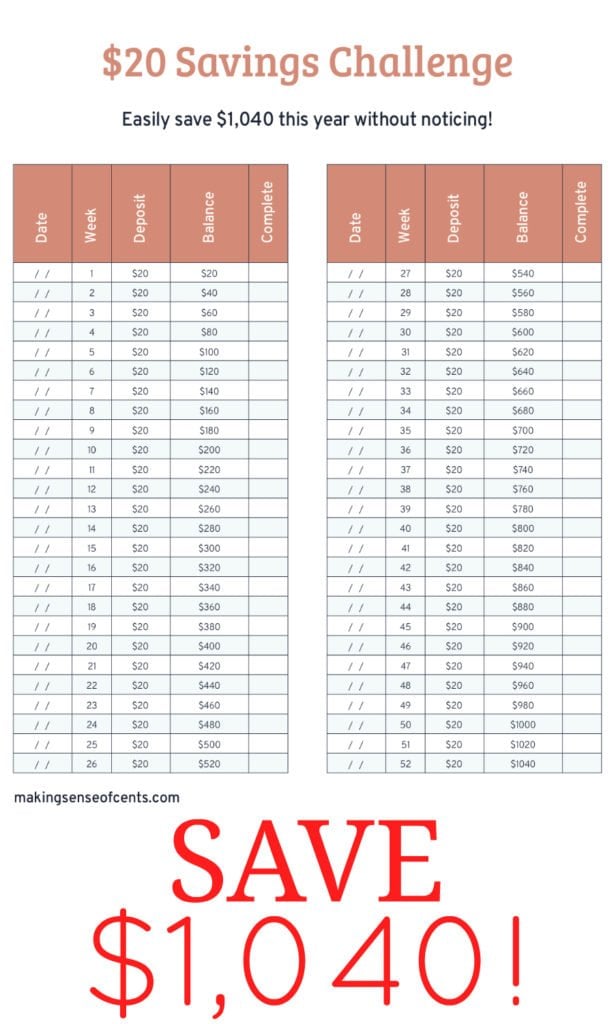

Recently, I created a fun printable for all of you called the $20 Savings Challenge so that everyone can learn how to save money.

The $20 Savings Challenge is a great way to easily save $1,040 this year without noticing! All you have to do is save $20 each week for a year, and then you’ll easily have $1,040. If you start this now and do it just until the holidays, you will have a nice chunk of change as well!

And, it’ll make saving money just a little more enjoyable.

Yes, saving money can be fun!

So many people get tired of paying off debt and saving money, because it can feel so monotonous or they just lack the motivation.

Related:

- 12 Work From Home Jobs That Can Earn You $1,000+ Each Month

- 75+ Ways To Make Extra Money

- How To Work From Home Selling On Amazon FBA

- How I Earn Over $100,000 a Month Blogging

- How To Start and Launch A Successful Blog – A Free Course

- How To Live On One Income

- 30+ Ways To Save Money Each Month

- Free Debt Payoff Plan Worksheet

Challenging yourself, such as by starting the $20 Saving Challenge, to save more money is great, because it can help keep your financial goal on your mind and keep you motivated.

Please download my free worksheet, the $20 Savings Challenge by filling out the form below. With this fun challenge, you can easily save $1,040 this year without noticing!

If you are new to my blog, I am all about finding ways to make and save more money. Here are some of my favorite sites and products that may help you out:

- Start a blog. Blogging is how I make a living and not too long ago I never thought it would be possible. I have earned over $5,000,000 online over the years on my blog and you can read more about this in my monthly online income reports. You can create your own blog here with my easy-to-use tutorial. Also, I have a free How To Start A Blog email course that I recommend signing up for.

- Sign up for a website like Rakuten where you can earn CASH BACK for just spending like how you normally would online. The service is free too!

- Answer surveys. Survey companies I recommend include Swagbucks, Survey Junkie, Pinecone Research, and Harris Poll Online. They’re free to join and free to use! You get paid to answer surveys and to test products. It’s best to sign up for as many as you can as that way you can receive the most surveys and make the most money.

- Save money on food. I recently joined $5 Meal Plan in order to help me eat at home more and cut my food spending. It’s only $5 a month (the first two weeks are free too) and you get meal plans sent straight to you along with the exact shopping list you need in order to create the meals. Each meal costs around $2 per person or less. This allows you to save time because you won’t have to meal plan anymore, and it will save you money as well!

- Cut your TV bill. Cut your cable, satellite, etc. Even go as far to go without Netflix or Hulu as well. Buy a digital antenna (this is the one we have) and enjoy free TV for life.

- Try InboxDollars. InboxDollars is an online rewards website I recommend. You can earn cash by taking surveys, playing games, shopping online, searching the web, redeeming grocery coupons, and more. Also, by signing up through my link, you will receive $5.00 for free just for signing up!

Leave a Reply