Welcome to my Albert App Review.

Looking for an all-in-one personal finance app that will help you manage your money, save for your future, or even get a free cash advance when you need it?

In that case, you’ve come to the right spot!

In this Albert App Review, I’ll go over everything you need to know about the popular Albert app, and I will discuss its features, benefits, how the app can help you, and more.

The Albert app is becoming more and more popular as a money tool that can simplify your life. Instead of needing a bunch of different financial apps, Albert can help you consolidate your phone and need less. The app is a one-stop shop for your monthly financial needs – it automates savings, helps you manage your budget, and has spending, borrowing, and investing tools. With this easy app and the wide range of tools that you can use, Albert has many benefits.

This app reduces the need for multiple apps since it offers a wide range of tools and features.

If you’re looking for a money saving app, Albert can be a great option to start with. There’s a reason why it’s one of the top money apps in the App Store!

Quick Summary – Albert App Review

- Albert app is a financial management tool that helps you to save, spend, and invest right in the app

- The Genius feature allows you to ask any money question and get a real response from a real person

- Albert app’s cash advance feature can get you up to $250

- The app is free, but some features do require a monthly subscription

Albert App Review

What Is The Albert App?

The Albert app is a personal finance app that will help you manage your money better by making it easier to save and invest all in one place. This app has features for saving, investing, budgeting, and more.

It has many different features, such as budgeting tools, real-time alerts, and a helpful service where you can ask an expert money questions and get real answers catered to your situation. The app strives to make financial management easier and more organized for everyone.

Albert makes it easy to manage your finances, eliminating the need for visits to physical bank branches or formal phone calls with a financial expert. With the ease of using an app, you can easily track your financial well-being, helping you stay organized, reach goals, and find smart ways to save, spend, and invest. Albert stands out by simplifying your personal finances, all while keeping things very easy to use.

Albert also has a feature where you can get a small cash advance of up to $250 with no late fees, interest, or credit check. This advance is repaid from your next paycheck, giving you the option to avoid high-interest personal loan lenders for those in need of quick cash.

There are no hidden fees, and it is free to sign up. They do have a paid subscription plan that you can sign up for which will give you access to different features such as financial advice from experts. I talk about the paid part further below.

Does The Albert App Give You Money?

Albert provides instant cash advances to users who need small amounts of money before their payday. They do not charge late fees, interest, or run a credit check for this feature.

This can be a great way to not pay high rates on payday loans for when you just need a little bit of cash.

How it works is that the Albert app will send you up to $250 from your next paycheck straight to your bank account. Then, you simply repay them when you get paid. You can pay a small fee to get your money instantly, or you can wait 2-3 days and get the cash advance for free.

Albert Instant is available to all members of the Albert app who qualify, whether they are a paid subscriber or not. Now, not everyone will qualify. To determine your eligibility for a cash advance, they look at things such as if your income is direct deposited into your connected bank account, if your bank account has been open for at least 2 months and has a balance greater than $0, and if you’ve received consistent income in the past 2 months from the same employer.

Albert App Features

The Albert App has many other features, such as:

Banking with Albert

Albert has a user-friendly banking service through its partnership with FDIC-insured Sutton Bank. This includes features like no minimum balance requirement and access to your paycheck up to two days early.

With an Albert account, you can also earn cash back rewards, such as getting a cash back bonus on gas, groceries, and more when you purchase items with your Albert debit card. You can earn an average of $2.00 per gas tank fill-up. You do need to be a Genius subscriber to take advantage of this benefit.

The app also has fee-free ATMs for their paid subscribers at over 55,000 ATMs (when using the Albert Mastercard debit card).

Albert Savings

Albert Savings is the app’s automatic savings tool that is available to Genius subscribers. It saves money from your linked bank account to your Albert Savings account.

This automated savings tool helps you build up your funds without the stress of manual transfers. It analyzes your income and expenses to calculate the amount you can save comfortably. Or, you can manually set your own savings schedule.

The Albert saving feature can help you to save more money and reach your goals.

The money in your Albert Savings account is yours, and you can withdraw it at any time.

Albert Budgeting

The Albert Budgeting feature is super handy and packed with a bunch of useful tools to help you manage your money with ease.

The Albert app has budgeting tools to help you track your income and expenses, find fees that you shouldn’t be paying, and watch your financial progress. The app will send real-time alerts and notifications to help you stay on track with your budget. But, that’s not all.

Other features of Albert Budgeting include:

- The Albert app can negotiate your bills so that you can save money. The app will help you lower your bills such as for cable TV, internet, cell phone, and more.

- The Albert app also makes it easy to see all of your budgeting info in one quick place, such as tracking your recent bills, seeing how much you’re spending in different categories, and more.

- The app will categorize your spending so that you can see where your money is going (this can help you to realize where you may need to cut back)

- Also, the app will help you find hidden charges and subscriptions that you may not be using.

These are all very helpful features that can help you save a lot of money in the long run.

Albert Investing

If you’re new to investing or you’re looking for an easier way to invest, the Albert Investing side of the app can make getting started much, much easier.

With Albert Investing, you can start an investment portfolio that matches the amount of investment risk you want to take on and your financial goals. The app even provides investment guidance and lets you start investing without any minimum investment amount needed.

So, that means that you can start investing with Albert Investing with just $1.

You can get started investing in the app by answering some questions (the app wants to learn more about you so that it can make selections based on your personal situation). The app will then choose individual stocks or funds for you to invest in (or, you can choose these yourself if you know what you want to invest in). You can even ask the app to only invest in themes as well, such as companies that are interested in sustainability and the environment. You can then continue to invest automatically or on a recurring schedule. The auto-investing feature can be a great tool if you are looking to save time and invest regularly without really thinking about it.

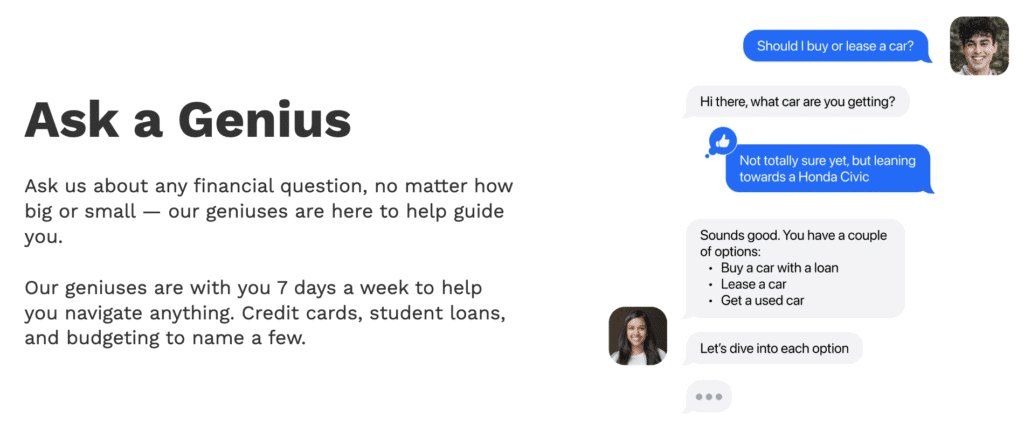

Albert Genius

This is one of my favorite parts in the app.

The Albert Genius service gives you financial advice from a team of expert financial advisors (this is a team of real human experts that you are able to talk to – not a robot), available through a paid monthly subscription in the app.

You can ask their experts any money question that you have, whether it’s a big or small question, a general question, or something more specific to your personal situation. Your questions can be about anything from credit cards, budgeting, student loans, investing, credit card rewards, life insurance, your personal financial life, and more. These experts will help you answer your questions 7 days a week too. And, there’s no limit to the amount of questions you can ask.

This is a very nice feature to have access to.

Some of the questions you can ask include:

- How do I start a budget?

- How do I lower my car insurance? Am I paying too much?

- How much can I personally afford to spend on a house?

- How can I improve my credit score?

- How much money should I have in my emergency fund?

- Should I use extra cash to pay off debt or invest?

- Can you help me to better under travel miles and credit cards?

There are so many different questions that you can ask the team at Albert!

Albert Protect

Albert Protect is a feature for paid subscribers on the app.

The Albert Protect feature monitors your money around the clock. The app will alert you if something suspicious comes up for any of your connected financial accounts or your identity. The app continuously watches for suspicious activity on your credit report, the dark web, data breaches, and unusual charges.

How Does The Albert App Work?

Signing up for Albert is easy!

Or, you can head to the Google Play or App Store, depending on your device (Android or iOS), and download the app. Once installed, the app will walk you through the setup process. There’s no need to worry about a credit check as Albert doesn’t require one for signing up.

Next, you’ll be asked some questions about yourself such as your name and age. The app is trying to learn more about you. Here’s what Albert says specifically about the questions that they ask: “We do this in order to best serve your needs: a 19-year-old single student has different financial objectives and priorities than a 37-year-old professional with two kids who will be starting college soon.”

Then, you’ll be asked to connect your financial accounts to the app. So, you may connect your bank account that your bills come out of, your credit card accounts, student loans, mortgage, investments accounts, and more. You can connect as many or as little as you want. This information helps the app better serve you so that it can give you recommendations, track your spending, give you alerts, and more.

After you sign up, you’ll have access to the many features mentioned above to help you manage your finances. As you learned above, there are a lot of tools in this app, so I recommend just playing around in the app at first to better familiarize yourself with it and see how it can help you. Maybe sit down for a few minutes at a time until you understand how to use the app in the best way for your financial situation. That’s exactly what I did when I first downloaded the app because it was a little intimidating at first trying to see all of the different things that the app can do. But, it’s so nice that everything can be done right from one app!

To sign up for the app, they do require that you be a U.S. citizen or resident, be at least 18 years old, and have a bank account with a U.S. financial institution. Unfortunately, at this time, the app is not available to those outside the U.S.

How Much Does Albert App Cost?

The Albert app has a lot of different features, so you may be wondering what the cost is or if there are any monthly fees.

The great thing is that many of the tools and features on the Albert app are free.

For example, the Albert App has a fee-free cash advance feature to help you cover unexpected expenses. If you need some extra cash until your next paycheck, you can get up to $250 as a cash advance, with no cost. There are no late fees, overdraft fees, or maintenance fees associated with this service.

You can also start investing with as little as $1 and use the free cash advances feature (as long as you meet eligibility requirements) without the need for a subscription.

Now, the Genius subscription does have a cost.

If you’re looking to unlock all of Albert’s helpful budgeting, saving, and investing tools, you might want to consider their Genius subscription. This subscription starts at just $14.99 per month and gives you access to some helpful benefits like cash bonuses and personalized financial advice. Keep in mind that the true value of the Genius subscription depends on how often you use the app and all its features. So, if you’re a frequent user of the app, it could be a great investment in your financial well-being.

Is Albert App Safe to Use?

Yes, Albert is safe to use.

Let’s start with the basics – the Albert app isn’t a bank, but it teams up with FDIC-insured Sutton Bank to offer you banking services. That means that the money in your Albert Cash account is safe because it’s protected by the Federal Deposit Insurance Corporation (also known as FDIC). That’s a fancy way of saying your funds are insured for up to $250,000.

Your Albert Savings accounts are held at FDIC-insured banks, including Coastal Community Bank, Axos Bank, and Wells Fargo.

When it comes to data security and privacy, Albert takes that seriously too. The app has security measures to protect your sensitive personal and financial information.

As for customer service, if you ever face any issues with the Albert app, you can easily reach out to their support team for assistance. Many Albert app reviews have mentioned their responsive customer service.

Pros and Cons of Albert

Like with any personal finance app, there are pros and cons. I can’t write an Albert app Review and not talk about the pros and cons, so that you can make the best decision for yourself.

Some of the benefits of using Albert include:

- The app aggregates all of your accounts – Albert gives you an overview of your financial life by combining all your accounts in one place.

- Savings and investments – The app offers customizable savings goals and can create a custom portfolio for your investment needs. It will also keep track of your transactions and help you identify potential savings opportunities as well as avoid late fees.

- The Albert app is safe – Your information is kept safe with the same level of security used by major banks, as well as FDIC insurance.

- Albert Genius – This feature provides personalized money advice from financial experts (real people, not a robot!) to help you make smarter financial decisions. You can ask any money question and will get personalized advice.

- Free cash advance – Get a cash advance on your next paycheck without any late fees using Albert Instant, or access your paycheck up to two days early with direct deposit.

- Free ATM withdrawals – This is a feature paid monthly members get to have.

While Albert has many helpful tools and features, there are some potential downsides to using the app such as:

- App-only functionality – All features of Albert are limited to the app, which may be inconvenient for some people who prefer to be on their computer instead of their cell phone.

- Fees – While many features in Albert are free to use, some, such as the Albert Genius service, require a subscription fee. The fee is quite affordable for the services you receive, though.

- No phone calls – If you need to talk to customer support, there is no phone number to call. Instead, it’s all done through the app, text message, or email.

Frequently Asked Questions

Here are answers to commonly asked questions about the Albert app.

Is Albert a trustworthy app?

Yes, Albert is a trustworthy app. Your banking money is FDIC-insured, with coverage up to $250,000, and your investments are SIPC-insured. The app has many financial tools and you can even get personalized advice from experts.

How much can you borrow with Albert?

The maximum for a cash advance is $250.

How do you get $250 from Albert app?

Albert offers a cash advance feature called Albert Instant. After you enable this feature and meet the requirements, you can access funds quickly, sometimes up to $250.

Does Albert give you money right away?

In some cases, Albert can provide instant cash advances or help you get your paycheck up to two days early via direct deposit, depending on your employer and banking situation.

How long does it take to get money from Albert?

Getting your hands on the cash you need from Albert is all about the service you’re using. If you’re in a hurry, instant cash advances could have those funds in your pocket right away. But for paycheck advances and other features, it might take a couple of days before you see the money.

What are the requirements to get a cash advance on Albert?

Requirements for a cash advance with Albert include a history of consistent income, using the Albert app for a certain period, and having a bank account linked.

Does Albert hurt your credit?

Albert does not directly impact your credit score as it is not a lender. However, using the app’s guidance to improve financial management can help you work towards building or maintaining a higher credit score.

Does Albert need your social security number?

Yes, when signing up for the Albert app, it will ask you for your SSN. This is because it is an investment app and they need to verify that it is actually you signing up.

Is Albert or Chime better?

Albert and Chime are different financial apps with different features. Albert focuses on money management, investing, and advice, while Chime is a mobile banking app offering checking and savings account services. Your choice should depend on your financial goals and preferences.

Why is Albert taking money from my account?

If you’re already an Albert user, this may be a troubleshooting question that you have (and perhaps you searched Google and found this blog post). Albert takes money from your account (such as your bank checking account) to fund the services you’ve opted into, such as investments or automatic savings. You can check the app’s settings or contact Albert to learn more,

Is Albert app affiliated with a specific local bank?

Albert is backed by Sutton Bank.

Is the Albert app reliable and secure for banking?

Yes, Albert is a reliable and secure app for managing your finances. It is FDIC and SIPC-insured and has a variety of financial tools and resources to help you improve your financial situation.

How is Albert app customer service?

I did some research and I found great Albert app reviews on their customer service. The Albert app has customer service options within the app and online. They do not have an option to call their customer service and speak on the phone. But, if you’re like me, you probably prefer to get your questions answered via text message or email anyways.

Is Albert app legit?

Yes, the Albert app is a legitimate personal finance app that can help you manage and improve your finances. Millions of people (last I checked, over 10,000,000 people use this app) use the app’s many helpful tools. The app is available for people on Apple or Android devices and it has great reviews.

Who is Albert app best for? Who should not use it?

The Albert app is a helpful all-around financial app that can help many different people. If you’re looking for an all-in-one app to help you save, spend, borrow, and invest, Albert might be a good fit for you. The app is helpful for people who:

- Want fee-free cash advances up to $250 (this is a feature that many people like because they don’t have to sign up for high-interest rate loans when they just need something for a short amount of time)

- Need an app that gives you an overview of all your accounts in one place

- Are interested in automatic savings and easy investing tools

Albert takes the work out of managing your finances and may be helpful for people who are trying to stay on top of their personal budget without having to juggle multiple apps.

However, Albert may not be the best fit for everyone and not everyone needs to have it. So, if you fall into any of the below, then this may not be the app for you

- If you’re an experienced investor looking for more advanced trading tools, then this may not be the best investing app for you (the Albert app is basic in this area because I think it caters more to those who are new investors or are looking for something easier to manage)

- If you’re someone who doesn’t feel comfortable linking their bank accounts to a third-party app (you will need to link accounts in order to get full use of the app – I understand that some people may not want to do this)

Albert App Review – Summary

I hope you enjoyed my Albert App Review.

I think this is a very helpful app, and I can see why it’s one of the most popular money apps today.

Albert is an app designed to help manage your saving, budgeting, investing, and more, all in one easy app. The app has all of the different money tools that you would want, plus some extras that you may have not realized you needed yet.

Albert is an app that helps you to manage many different parts of your financial life right from your cell phone (it’s not available on computers).

They even have the Genius feature (one of my favorite parts of the app), which is an in-app chat where you can ask one of their experts anything related to money, from credit cards, buying a car, student loans, and more. This is very helpful if you ever have questions about money.

And, if you need cash now, Albert may be able to give you a small advance of up to $250. There are no late fees, interest, or a credit check. If you want to avoid personal loan lenders who have high-interest rates, and only need a small cash advance, then Albert may be a place to start with. How this works is that they send you $250 from your next paycheck. You simply repay them when you receive your next paycheck.

You should keep in mind that investment options don’t include retirement plans and customer service can only be reached via email and text. Though the app’s budgeting tools are more basic compared to budgeting-focused apps, the Albert app still has many, many benefits to help you manage your finances effectively and it’s all from one easy-to-use app.

What’s your favorite personal finance app? Do you use the Albert app?

Leave a Reply