Do you have life insurance? Today, I am sharing my Policygenius review to help you find an affordable and easy place to find life insurance.

Life insurance is extremely important.

And, it’s probably something you can easily afford. In fact, many people are able to find life insurance plans for less than $50 a month – there are extremely affordable plans out there!

Yet, many people go without life insurance.

If you’re unfamiliar with what life insurance is, I want to start my Policygenius review by explaining what it is.

See, life insurance is money for your family for when you pass away. If you are the sole or primary earner in your family, then there are probably a lot of people who rely on you financially. And, if you are a stay at home parent, life insurance is still extremely important as well.

The money that comes from life insurance can be used to pay for funeral expenses, day-to-day bills (such as your mortgage or rent), to pay off debt, to hire help for the family (such as a nanny or daycare), set up college funds, etc.

Think about it like this: If you were to die tomorrow, how would your family be able to cover the bills?

According to the Insurance Information Institute, in 2020, 54% of all people in the U.S. had some sort of life insurance. However, many of those people don’t have enough life insurance coverage. That means their policy likely doesn’t meet the needs of their family.

This also means that 46% of people in the U.S. do not have any form of life insurance. That’s a lot of families who are not protected in the event of an untimely death.

If you don’t have life insurance or if you only have employer-provided life insurance, I recommend getting your own life insurance policy. That’s why I wanted to do this Policygenius review – to help you find an easy and affordable way to find life insurance.

If you have life insurance through your work, I still highly recommend getting your own life insurance policy as well. This is because the policy through your work usually doesn’t offer enough life insurance coverage, plus if something happens to your job, then you may lose your policy.

Sadly, I have heard too many stories about someone who’s lost their job, completely forgot that their life insurance was tied to their work, and then passed away. They and their family assumed the policy was still intact, but instead, they were left with nothing.

This is something that you do not want to happen to you or your family.

If you are looking for life insurance, one easy way I recommend is trying out Policygenius.

Policygenius makes getting life insurance easy. A quote takes just five minutes, and you can see comparable policies so that you can determine what is best for you.

You can click here to find a life insurance policy.

In my Policygenius life insurance review, I’m going to explain more about what they offer, how much life insurance costs, how Policygenius makes money, ratings and reviews, and more. If you have any additional questions, please leave a comment below, and I will get back to you as soon as I can.

Content related to my Policygenius review:

- Wondering Why You Need Life Insurance? Here Are 4 Reasons Why

- How I Retired At Age 30 with $500,000

- 14 Smart Money Moves To Make This Year

- Do I Need A Will?

Here is my Policygenius Review

Who needs life insurance?

The reality is that not everyone needs life insurance. However, most people do.

It’s recommended that you have life insurance if:

- You have a family. If you have a spouse and/or children who depend on you and/or your income, then you should have life insurance. In addition to covering any bills or debt that you may leave behind, a life insurance policy can help them pay off the mortgage, pay for their college education, and more.

- If anyone has cosigned a loan for you. For example, if you have a parent who has cosigned on your student loans, or if someone is a cosigner on your car loan, then you should have life insurance. This is because if something were to happen to you, then they would be stuck with your debt.

- If you are young and healthy. Even young people can benefit from life insurance, and the added benefit is that you can typically lock in a more affordable life insurance rate now instead of later. Because life insurance tends to get more expensive as you get older, buying a policy when you’re young may save you money.

If you are looking for life insurance, I recommend checking out Policygenius. Policygenius makes getting life insurance easy, no matter what stage of life you are in.

In just five minutes, you can get a quote with comparable policies so that you can determine which one is best for you. There’s no charge to get a quote.

What is Policygenius?

I’ve already talked a lot about the benefits of Policygenius, but it’s important that you understand what it is. Policygenius is a website where you can find life insurance.

They are not an insurance company, and there aren’t Policygenius life insurance policies – they simply help you shop for one!

This is a platform where you can compare different life insurance policies from many different companies. It’s a way to compare rates to find the best life insurance for you.

Policygenius has helped over 30,000,000 people shop for insurance over the years.

On Policygenius’ website, you can find life insurance policies from companies such as Protective, Banner Life, Lincoln Financial, AIG, Brighthouse Financial, Foresters Financial, Prudential, and more.

Policygenius also offers other types of insurance, such as home insurance, car insurance, disability insurance, renters insurance, long-term care insurance, pet insurance, travel insurance, jewelry insurance, vision insurance, and more.

You can compare rates for those types of policies in the same way you use Policygenius for life insurance.

What does Policygenius do?

You may be wondering why you can’t just purchase your life insurance directly from a life insurance company.

Well, you can, and some people do.

However, what’s nice about Policygenius is that you can shop around in one, simple place. Without Policygenius, you would have to contact each company individually and get quotes.

That’s easier than it used to be because you can get quotes online, but it still takes extra time.

Plus, law requires that the final rate, whether you buy the policy through Policygenius or directly from an insurance company, is the same amount of money.

You aren’t paying extra to use Policygenius, and you aren’t saving money buying direct.

Policygenius actually helps you shop around so that you can save the most money, and they do all the work for no extra cost.

How much does Policygenius cost?

Policygenius is free to use! There is no cost to shop for insurance on their site.

And, surprisingly, life insurance is much more affordable than you probably realize.

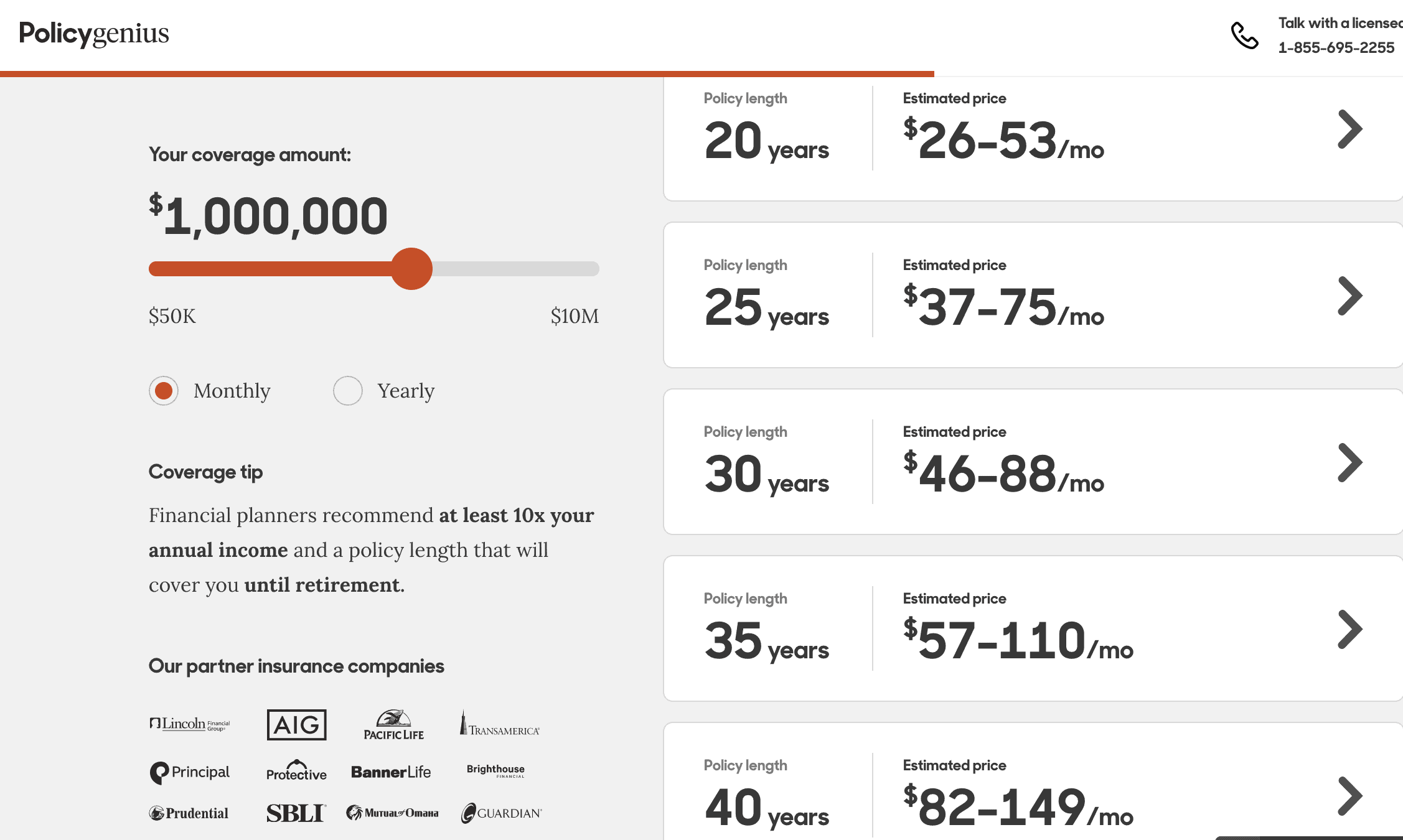

I did a quick search through Policygenius, and I was able to find a $1,000,000 policy for 20 years, for as low as $26 per month.

The monthly premiums are most likely much more affordable than you thought.

How much is a life insurance policy?

Many people skip life insurance because they think it’ll be too expensive. However, that’s far from the truth! Typically, you can find a policy that offers $1,000,000 in coverage for around $50 per month.

You can even find life insurance policies for less than $25 a month.

PolicyGenius has a life insurance calculator that will help you see how much it will cost for different amounts of coverage.

The cost depends on factors like your age, lifestyle, location, and amount of coverage you want.

What types of life insurance are there?

There are two main types of life insurance:

Term life insurance

Term life insurance covers you for a set number of years, and it is typically the least expensive option. You can use a term life policy to carry you through your working years and while your retirement fund grows. Once you reach retirement age, you should have enough aside to cover you in case of an emergency. Most young families will be best with term life insurance.

Your term life insurance policy only pays out upon death, so there are no other financial benefits to it after that. Honestly, that’s all that most people need life insurance for anyway.

Whole life insurance

A whole life insurance policy is one that covers you for your entire life, and because of that, it is much more expensive. It also may have a cash value, investment options, etc. Those are all reasons why it is much more expensive than term life insurance. There are many reasons to choose one type of policy over another, but a whole life insurance policy might be a better option if you have a dependent who will need long-term care.

How does Policygenius get paid?

If Policygenius doesn’t charge, then how do they make money?

See, Policygenius is an independent insurance broker. They get paid a commission for each life insurance policy that they sell, and it’s the life insurance company that pays their commissions.

So, you do not pay PolicyGenius anything else – their insurance commissions are built into the price of the insurance policy that you are buying.

Policygenius does not give any preference over one insurer over another. Instead, they are there to give you the best life insurance policy options.

How do I get life insurance through Policygenius? How does Policygenius work?

If you’re reading this Policygenius review and are interested in using their platform to shop around, let me explain how it works.

You simply can follow these steps below:

- Head on over to Policygenius.

- There is a simple application that asks for information about your age and zip code, and you will need to answer some medical questions.

- Then, Policygenius will give you some coverage estimates. Here, you can choose your policy length (how many years do you want your life insurance policy to last?) as well as how much you’d like to be covered for.

- Next, you will choose one of the options for a policy, and fill out an application. Policygenius will connect you with a licensed agent so that you can get an accurate life insurance quote. Don’t worry, there are no sales pitches! When you’re talking to an agent, you can ask them any questions that you may have, what the next step is, and so on.

- Buy life insurance.

Again, there is no fee to look or even buy your policy through Policygenius.

Do I need to take a medical exam?

You will most likely have to get a medical exam during the signup process. If you are healthy, you may be able to skip it, though.

You can ask the agent about this while you’re getting your quote.

Is Policygenius a good insurance company?

Policygenius ratings are very good overall. The average Policygenius BBB review is a 4.7 out of 5. Google reviews of Policygenius are 4.7 out of 5.

There are Policygenius complaints, but that’s true for every company. I read through many of them to prepare for this Policygenius review, and here’s what I found:

- Someone complaining that they didn’t receive a referral bonus

- Another person complaining that Policygenius wouldn’t disable their account, to which Policygenius responded explaining they have to keep it because the person had a policy through them

- Delays with the application process

I want to remind you how many positive Policygenius reviews there are compared to negative ones. On Google, out of 979 reviews, they still have a 4.7 out of 5.0 rating.

Policygenius Review

Life insurance is extremely important for most people, plus it’s affordable.

However, many people do not have it.

If you do not have life insurance, then I recommend looking into Policygenius as soon as you can.

Policygenius is an easy way to compare different life insurance policies and find the more affordable and best option for you and your family.

You can check out Policy Genius here.

Do you have life insurance? Why or why not? What else would you like to have learned in my Policygenius review?

*Statistic from the Insurance Information Institute

Leave a Reply