This Credello review is in partnership with Credello.

Are you looking to finally take control of your finances? With the Credello money tool, you can get personal guidance that will help you to make better money decisions all from your phone.

Credello is a tool that helps you to make easy financial decisions so that you can borrow, save, and invest through personalized recommendations that they give you.

The solutions that they give you fall in the below categories:

- Debt – Credello will show you how to pay off your debt faster, which may include showing you debt consolidation options.

- Personal loans – Credello will show you the lowest interest rates on personal loans customized to you, and how you can apply.

- Credit cards – Credello will show you which credit cards are best for you and your financial situation. The Credello tool will also show you how to improve your credit score.

- Home equity loans – Credello will teach you about home equity loans and HELOCs.

As you can see, there are many different areas in which Credello can help you out.

If you have debt and are looking to repay it faster, then this may be an option for you to look into as they have several different helpful tools to try out.

Related content: 4 Things About Debt You’re Confused About but Too Embarrassed to Ask

Here is my Credello review.

What is Credello?

Credello is a personal finance platform that helps consumers like you and me make the best decisions for themselves. Credello gives personalized advice and tips in order to do this.

Some of the great things about Credello include:

- They help consumers compare products that meet their needs without you having to share personal information. I know that sharing personal information in order to see recommendations can be extremely annoying. Thankfully, Credello does not require that!

- They are not biased. They don’t show products that only make them money, instead, they show solutions that are available to you whether or not it makes them money.

- Credello makes product choices easier for you. You don’t have to do additional research if you don’t want to. Instead, Credello makes it as easy as possible.

This money tool is easy to use, and the questions are simple to answer. If you have debt, Credello may be a great place to start to learn more about how to become debt free.

How does Credello work?

Here’s how Credello works:

- First, you will answer some questions that are easy and basic so that Credello can learn more about you and your financial situation.

- After that, you will then share your money goals with Credello so that they can make personalized recommendations.

- Next, Credello will show you different solutions, talk about how they compare, and list out how well they match what you need.

- Lastly, Credello allows you to prioritize the different options that you have so that you can choose the best option for you.

It’s very easy!

What does the Credello debt payoff calculator show?

Do you have debt? Do you want to pay it off quickly?

I enjoy playing around with different financial calculators, and this is one I would have enjoyed back when I had debt.

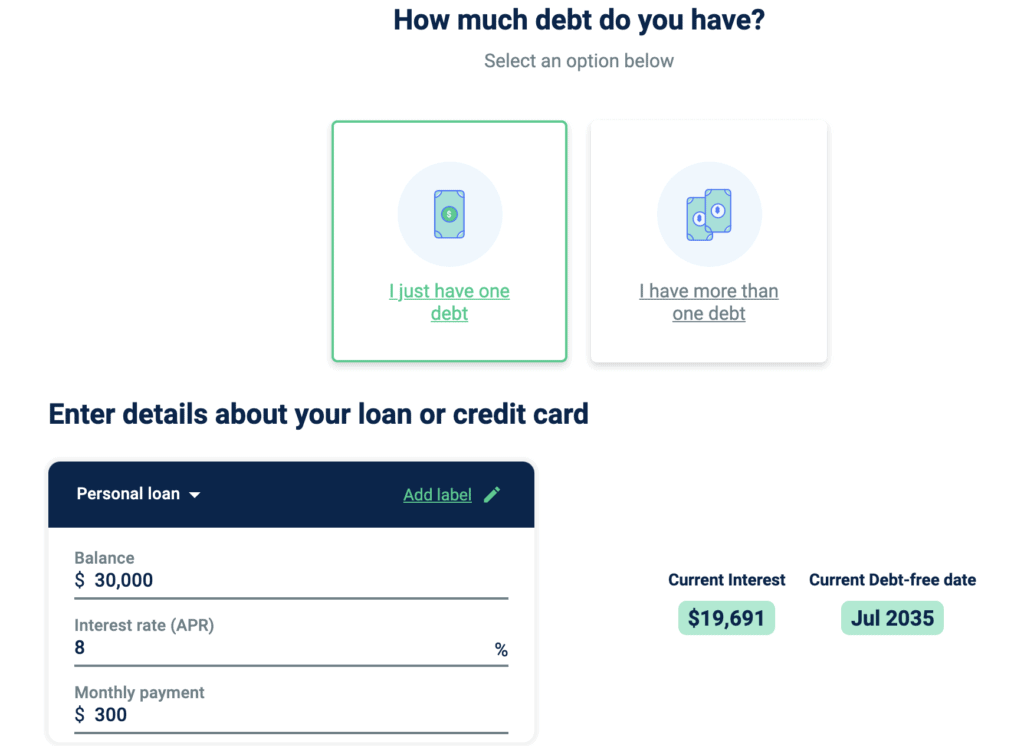

This debt payoff calculator is easy to use and it will show you how long it’ll take you to pay off your debt at your current rate as well as the amount of interest you will pay, how changing the monthly amount you pay will impact your debt payoff plan, and more.

To use this calculator, you simply just:

- Type in your debt information, such as how you owe, your interest rate, and your monthly payment amount.

- Next, you will be shown different ways to pay off your debt quickly, such as with the snowball and avalanche methods, and how this will impact your debt payoff progress.

- The tool will then show you how extra payments may help you become debt free faster.

- The calculator will then estimate your debt free date and calculate the amount of money you can save in interest.

You can see a screenshot example below.

You can check out their debt payoff calculator here.

How does Credello’s debt consolidation recommendation tool work?

If you have multiple loans, then you may want to look into a debt consolidation loan.

This is a loan that is used to pay off multiple loans, and then combined into one monthly payment.

There is usually a lower interest rate, which can help you save money and possibly pay off debt faster. Another positive is that a debt consolidation loan may help you to simplify your finances, as you will only have one loan left, instead of having multiple.

Debt consolidation loans aren’t for everyone, though. You will want to be sure that you understand whether there are any fees, such as origination or balance transfer fees, annual fees, and so on. Plus, you’ll want to make sure that you can make all of your payments.

Consolidating your debt may be for you if you have a good credit score (so that you can get a low interest rate), you want to simplify your debt into one monthly loan, and you want a fixed monthly payment with a clear end date.

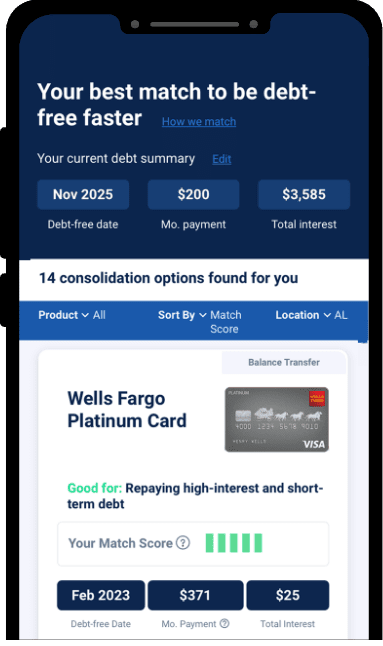

Credello has a money tool that will allow you to compare different debt consolidation options that may be available to you.

This money tool gives you unbiased recommendations which also includes personalized matching – so that you know what may be the best option for you.

Plus, you don’t have to share personal information or connect to any accounts to see Credello’s recommendations.

Here’s how it works:

- You simply answer easy questions about the debt that you have and your financial health.

- Then, you’ll tell Credello why and how you want to consolidate your debt. This helps them give you personal recommendations because they will know your financial goals in life.

- Next, you’ll receive a list of debt consolidation recommendations that you can compare side-by-side.

You can see how it easily works in the image below.

Please click here to check out Credello’s debt consolidation tool.

Is Credello safe? Is Credello legitimate?

Yes, Credello is safe.

They ask basic questions to give you personalized results, and I did not come across any questions that were too personal as I was reviewing Credello.

This is something that I like about Credello, as too many money tools these days ask you for your social security number right away, or for you to connect your accounts. Credello simply gives you recommendations so that you can learn about your different options.

How much is Credello?

Credello is free to use for all. The company gets paid by some of their lender partners when a Credello user signs up for a loan with them.

My Credello review.

If you are looking to improve your financial situation and pay off your debt, then Credello is an option to look into.

Their personalized advice is easy to get, and there are no intrusive questions that they ask. There are no real big hurdles to see their recommendations either, which I liked because it made the whole process very quick.

You can get started with Credello by clicking here.

Do you have any questions you’d like me to cover in this Credello review?

Leave a Reply