Hey everyone! Please enjoy this great guest post from Joe and Kristin DiSanto. This is all about how they made the drastic decision to change their life and try something new – they went from chasing success to seeking fulfillment. I know that many people have felt “stuck” at times, and this can be a great read to help push you out of your box.

So…Hello!

So…Hello!

We are Joe and Kristin DiSanto, a former executive producer/business owner and a former film/commercial editor from Los Angeles. Since meeting and marrying in Los Angeles, we spent many years and grueling hours climbing to success in the advertising, film and television industries.

We went from often working for free, to building a post production company with our best friends that brought in millions of dollars, won Emmys, and fulfilled our lofty career goals.

AND THEN WE KISSED IT ALL GOODBYE to start a new life.

At the ages of 38 (Kristin) and 43 (Joe), we left our stressful big city careers and relocated to a charming Florida beach town where we knew no one, but had the freedom to raise our 3-year-old son full-time—and redefine our “dream life.”

We traded in time spent on work, for time spent together as a family.

Kristin is now able to be a full-time mom and part-time blogger. Joe is a part-time bookkeeper and small business consultant and part-time blogger.

No matter how much you love your job (we actually did love our careers), it just depletes your time, creativity and energy. So when you get home to your supposed “life”…you have little left to give.

We wanted to take back that life force, and attempt to hit the reset button.

How did we manage to pull this career shift off?

Well…a lot of financial planning, some good investments (mostly real estate), and a healthy fear of life passing by before we actually got a chance to live it. But even with most of our financial ducks in a row, NONE of this career shifting was easy.

We had a total breakdown in Austin, Texas (our first stop on the journey), and made a bunch of mistakes along the way that cost us emotionally and financially. For instance…I don’t know…saaayyy…moving halfway across the country with a toddler, twice in three months!

So, we’re going to relay our story to you in hopes that you can follow your own desires to change your life and venture into the unknown…with some valuable info under your belt. At the end, we’ll give you a transparent “before and after” breakdown of our finances so you can see how we were able to accomplish our life changes. And we’ll give you tips on how to save money during a big move.

Ok, here’s our story.

Meeting and Making it in La La Land

As a couple, we made a pact long ago to try and keep our lives interesting. When things were getting stale, we should push ourselves out of our comfort zones, and go bigger.

If life is a game, we wanted to win, and have as much fun as possible doing it. We lived very different lives in our youth, but somehow ended up with a similar shared desire to succeed, and we were able to find each other and take on the challenge together.

Joe grew up in Providence, Rhode Island, where he spent his youth riding bmx bikes, breakdancing and graffiti tagging “Smash” around town. Kristin is a former musical theatre nerd turned film nerd. She grew up taking tap classes, attending Broadway shows and singing at church in Grand Rapids, MI. Fate brought our two strangely divergent paths together at a Venice, CA music video post-production house, where we fell in love and set out to achieve our dreams in the entertainment industry in August of 2002.

By 2004, Joe bought his first home, and we moved into it together! Luckily by a few years later, with the help of that house and a few diagonal moves on the work front, he managed to get himself fully out of student loan and credit card debt ($75,000). Kristin was steadily climbing the ranks of commercial editing along the way as well, and was finally starting to catch some breaks. In late 2005, Joe and his partners broke off and started their own company, which Kristin soon joined.

From 2006 to 2018, we managed to built a multi-million dollar post production company with our best friends, helped create and edit critically acclaimed films, commercials, and an Emmy winning TV show, got married on a mountaintop in Santa Barbara, bought 8 investment properties and our beachside dream home, and then, in 2018, left all that achievement behind.

Why?

Two main reasons: inertia, and the birth of our son.

First, Let’s talk about inertia. We had made that promise to each other to keep our lives exciting, and without realizing it, our life had developed, shall we say, a cage-like predictability. We came to refer to this phenomenon as “The Golden Hamster Wheel.”

We seemingly had it all figured out. We had a successful business, we were living in a “great house” in a “great neighborhood” with “great schools” (hard to come by in LA). Our commute to the new office, that Joe had recently completed construction on, was only 15 minutes away (that short commute was a MAJOR life bonus for anyone living in LA). And we worked on cool projects everyday with our friends.

We knew that it all SHOULD have made us completely fulfilled (and it did for a long while), but the truth was…it wasn’t doing it anymore. (It was actually really annoying that it wasn’t. Things would have been much easier if it was..haha!)

We felt like something was missing.

Somehow we couldn’t see then that we were running, like scared little hamsters, on that big ol’ shiny wheel we had so painstakingly constructed.

And then it happened…

Was the Missing Piece Our Progeny? (haha)

In 2015, we were overjoyed by the birth of our son. We expected it to be a difficult transition as we became new parents and then went back to work. But we figured after the first year it would be much easier.

We were wrong.

Not only did life not get back to normal, it got worse. Maintaining our lifestyle became much more complicated. We rushed to the office, leaving our son with a nanny all day (thank God she was the best human we could have ever hired).

Work had started to become more and more like a J-O-B, and less and less like our passion. One of us floored it back home to see our son just before bed.

We ordered our over-priced organic groceries online because we didn’t have time to go to the store. We had a housekeeper because we didn’t have time to clean or do laundry. We drove expensive cars, wore trendy clothes (ok, that was just Kristin), always had hair and nails done (Kristin, again), because we “needed” to project a certain image in our line of work.

We took our son to museums and restaurants and play dates on the weekend, tried to maintain our LA social life, failed to exercise, attempted to rejuvenate our romance occasionally, and at night we fell asleep just freaking exhausted—and then it started all over again the next day.

We felt like we were just going through the motions, and no longer actively playing the game. And frankly, we started to get sick of hearing ourselves complain. Our Golden Hamster Wheel was revealed to us in all it’s tedious glory.

We had to finally admit that we were basically working and buying our way through life—and paying for it in more ways than one. It’s astounding how you can work so hard to achieve a very specifically sought after life…and have it ultimately leave you feeling unsatisfied.

Over the years before having a baby, we had begun to wonder if our passion and drive would eventually wear out—that the long hours would suck all the energy and creativity out of us. We’d casually talked about how “someday, maybe we’d just quit our jobs and try something new,” but it was always a “someday” that was far off in the future.

And besides, why would we do that?!

We were living our DREAM LIFE, right?

The Catalyst for Our Cross Country Move

The birth of our son suddenly made clear that “someday” had most definitely arrived.

During the first two years of our son’s life, we hatched a plan to take a one year hiatus from work (how we would technically accomplish this was unclear, but most great things start as a dream!:). We came up with the idea to move close to one of our rental properties in Austin, TX, renovate it, then move into it, and then decide at the end of that year if we wanted to come back to our old life.

Initially, this was an easier pill to swallow than just leaving everything behind…FOREVER! But it didn’t take long for us to see that the likelihood of being able to come back (or wanting to) after leaving our careers and selling our home, was minuscule.

We decided we would have to leave indefinitely, and divest ourselves from the company and our jobs. It took about six months to activate our plan. It was a major undertaking of paperwork and awkward chats with stunned friends and colleagues (“Wait, so what are you doing? And why are you doing this?”), but it all came to fruition the morning we finally got on that plane and watched Los Angeles, and everyone we loved, fade into the distance.

It felt like life was just beginning for us again.

(that actually sounds kind of sweet when you put it like that, but spoiler alert, we weren’t feeling the warm glow of freedom, sunshine and a new life…we were kinda freaking the @#$% out).

Hello Austin, TX! (or “Dear God, What Have We Done?”)

As it turns out, the burbs of Austin was very brief stop for us—as in only eighty-eight days! It wasn’t exactly the beginning we’d imagined.

We like to think of it now as our “purgatory”, where we were sequestered while we detoxed from our achievement oriented lives in LA. For the first time, we were one-on-one with our son full-time, and we had no official jobs to pull us away.

NO JOBS!

We did have the renovation of our rental house, which we were living just a few minutes away from, but other than that, there was nowhere to hide from our fears.

It wasn’t long before the initial elation of leaving our careers turned into sheer panic.

“Are we COMPLETE IDIOTS??? What have we done???

Did we really quit our amazing jobs to live in a town so hot it literally feels like you are burning in hell!? And how can a place possibly have as many god-forsaken strip malls as they have blood-sucking mosquitos!?!”

And of course there was the constant moaning about “having no friends.”

Suffice it to say, there was a lot of crying after our move, and pointless daydreaming about how we could negotiate our way back into our old, safe lives.

What. Had. We. DONE.

Beyond our own personal fears, we also had our 3 year old son who was finding the change to be very difficult as well. When we read about people living in RVs with small children it always amazes us. Our son does not do well with CHANGE as it were. Just getting used to a new room took him a while, nevermind leaving behind his best friend and nanny, and then being introduced to preschool for the first time.

It was really hard on him, and we felt pretty bad about it. (Little did he know he would be moving into two more new rooms in the next 9 months before he was finally settled). Though admittedly, I think he was happy to leave Austin for Florida too..haha!

Okaaay, so sounds pretty great so far, right!? Ready for your own big move now? Ha ha! We’ll it’s time to turn this sad tale around. No, we didn’t run back to LA with our tails between our legs. Luckily, after spending way too much time feeling lost in a bottomless pit of anxiety, we were still sane enough to know that we HAD TO DO SOMETHING to help get us through our physiological turmoil.

Climbing Our Way Out of Despair

When you feel like you’ve lost everything that once defined “you,” it can be a good starting point to reevaluate who you really are without all the labels.

So, we tried to dig deep.

We started searching for…dun dun dun: “meaning.” Basically, we began voraciously reading books about “finding joy” and “life’s purpose.” We researched and started meditating. We downloaded courses on “gratitude.” We watched documentaries about happiness. We drank a lot of cheap Lonestar beer (not exactly digging deep but, hey, we’re human).

And you know what? It helped!

It started to make a significant difference. At times, we could actually peer through the thick fog of fear and see all that we had gained—instead of thinking about the “conveniences” and “comforts” we had given up. We began to more clearly see behind the curtain.

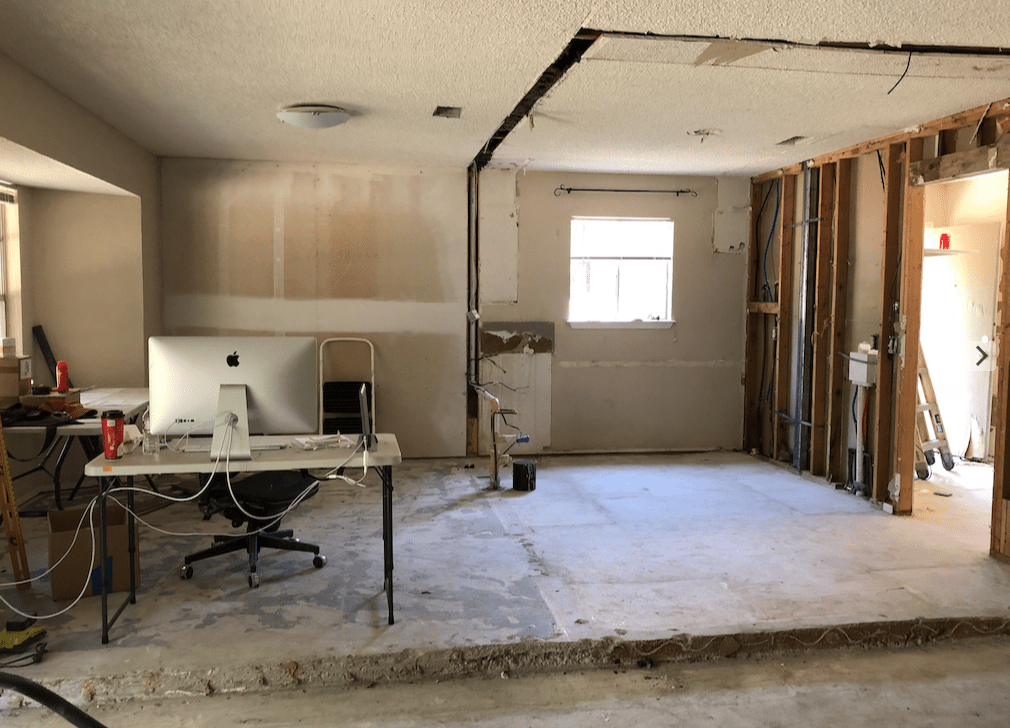

Rental Property Rehab

While our son was at preschool each morning, we went over to the rental house and scraped, painted, dug and scrubbed. We decided that, among other tasks, we were going to take on painting the entire interior of the house.

It’s possible we were romanticizing what this would actually entail, but let’s just say, we learned that painting a WHOLE house (from new drywall) is pretty tough and time consuming for a do-it-yourselfer. It is NOT a “meditative technique.” Perhaps we (Kristin) read Eat Pray Love a few too many times. As it turned out, painting the entire interior of a house was a frickin’ tedious undertaking.

We’d start out each morning very detailed and careful each morning, but after a few hours of painting we were spent, and we’d just end up slopping it on and thinking, “Yep, good job.” Painting isn’t rocket science, and almost anyone can do it, but it does test one’s inner (and outer) strength. It made us realize that we’d taken for granted all the painters who do professional work and keep it up hour after hour on a daily basis. (Sending out MAJOR high fives to all house painters everywhere.)

Strangely, though, the more days we worked, the more satisfaction we discovered in our small triumphs—like identifying and removing an invasion of poison ivy without contracting a rash…or learning how to use a paint gun like a ninja (paint rolling is for suckas). We had puffy swollen eyes, paint in our hair and fingertips so ripped up they were peeling off in chunks (damn you steel wool!), but we were gaining so much more.

Alright…don’t throw up when you hear this, but every morning at breakfast we each took turns writing down something we were grateful for to add to the “grateful jar.” (This was inspired by a Gratitude course we’d downloaded from the Insight Timer App. We swear it will change your life!)

We could literally see the results of all of our efforts stacking up in the glass jar.

Feeling gratitude for things like “The way our pepperoni pizza reheated so well in the oven” and “lightbulbs, because they make everything bright,” truly made us happier.

Ultimately we had to reluctantly admit, we couldn’t have picked a better place for our detox period. If we had moved to paradise with beaches and margaritas, it just would have distracted us from the work we needed to do in order to let go of our old lives.

We had to learn to relinquish the tight control we had maintained over every aspect of our existence, and just ride the wave you’ve got. (but to be clear we don’t surf. I think I got that from Pete The Cat).

Goodbye Texas, Hello…NEW US?

As much as we felt reluctantly rewarded (wait did I say reluctantly again?) by the metamorphosis of our Austin rental, and truly gained from the experience, we couldn’t wait to GTF out. Ha! We slapped a “for sale” sign up on our Texas house and luckily sold it for asking price.

Then, just three months after having packed all our belongings into a moving truck, we made a second major life decision to pack up and move our family, AGAIN. Not an exciting proposition at that point, but we saw it as the only way forward.

Where did we go? Well that’s a very modern tale involving the internet. We didn’t know where to go. When you are not driven to a place by either family or work, it’s actually surprisingly hard to “know where to go.” We knew we missed being near water and that we wanted a town with a charming main street.

Sooo…we googled “reasonably priced seaside towns with charming main streets”.

Yeah..weird.

Anyway, we made a list of six towns that looked really good in the pictures, and seemed to check off some or all of our boxes.

- Reasonably priced homes

- Reasonable to low property tax

- Hopefully no income tax

- Walkable

- Decent schools, etc etc.

It’s hard to get all these things in one town!

Then we said to ourselves, well we need to go visit these places. Problem was that we only had about 1.5months left on our Airbnb, and we still had a renovation to complete before that date arrived. So, we picked the town that seemed the most promising, and went for 5 days…Dunedin FL.

It’s hard to decide if you want to move somewhere in a few days, but we were NOT staying in Austin…and we didn’t have time to visit anywhere else on the list, so we were like, “Here we come Dunedin! (PLEASE PLEASE be a nice place to live, Dunedin!!!!).”

Well, fortunately, Dunedin turned out to be a wonderful place to live. We actually really love living here…THANK GOD. And this time around, we figured out a much cheaper way to move, which involved a smaller truck, less stuff and Joe driving it alone for two days (more on that in the numbers). Within a short time of being here, we also found a home we wanted to invest in and renovate!

After another “fun” 8-month renovation, we moved into our “new old” 1942 craftsman home (almost on our 1 year anniversary of leaving LA). It’s located just a short walk from the gulf, and even at that, our costs are significantly less than in LA. We both work from home, have one car, clean our own house, and spend most of our time with our son and some great new friends.

We’re more free to exercise (almost) every day, walk to restaurants for dinner (I know, just breathe into a paper bag FI/RE friends), and visit our families more than we ever have before.

We can’t say that it’s been easy to make this transition.

In fact, it was the hardest, craziest thing we’ve ever done, and our egos often put up a helluva fight.

But over a year after extracting ourselves from our former life, and with plenty of time for reflection on what we really want in this next chapter (which we refer to it as our “Scenic Route”), we know that we made the right decision for our family.

What Have We Learned?

First, we learned that quitting our jobs and moving to another state with a young child was “a big deal.” We both moved to LA when we were in our 20’s, from states far away, and it didn’t seem hard to either of us at the time. So I don’t think we could have ever guessed the impact it would have on us. Also after living in a place for so long, it becomes part of your identity, and that is hard to unwind.

In so many ways, we lost our family’s safety net. BUT, when you let go of everything and everyone you’ve been gathering around you for years to create your life, you’ll find that you DO eventually settle in. When you do, you begin to feel a weight lifted off your shoulders. Maybe it’s this freedom that allows you to evolve faster into a truer version of yourself.

Now we are not so concerned with “winning” the game, but are more interested in having the flexibility to adjust as we go. We want to be (as) financially independent (as possible), travel more, and possibly move abroad when our son is a bit older.

Also, we’ve learned to focus more on intrinsic goals—like living each day with gratitude—instead of extrinsic goals—like seeking recognition. (Although being able to live each day with gratitude deserves some kind of award, right?!?!) We have to keep working on this constantly! We definitely haven’t mastered this new way of viewing life yet.

Finally, we learned that we can move away and survive, make new friends, and have amazing adventures. When we first left LA, we weren’t confident about our decision, and had a lot of fear that we would just want to go back to the way things were. But now that we’re happy and doing well, we’re even more confident that we could try something crazier, like moving to a foreign country. But for right now, we’re staying put!!!

The Financial Details….

Our old Los Angeles monthly expenses vs our new Florida monthly expenses

So moving has essentially reduced our monthly expenses by about 60%. Most every area of our life is cheaper here, but not all by 60%. The biggest reductions in spending are our housing payment and child care costs. Plus we also have tried to tighten our spending a bit.

We also want to point out that the numbers here are actual expenditures, not a budget. For LA we used an average of Jan-Nov 2017, and for FL we used an average of Jan-Nov 2019. We didn’t use 2018 because we moved three times and lived in LA, Austin and FL. It was not a consistent comparison.

Child care costs are way less because we went from a full-time nanny to a full-time mom with some preschool. We would have eventually switched to school in LA, but not as soon. With Kristin working full-time, we would not have been able to do that until kindergarten, and then still would have needed after school care. It’s also likely that our Waldorf school here, would cost 2x more in LA.

The other major reduction is the cost of our home. With the sale of our LA home and some other real estate, we are able to own our house outright here, so the out-of-pocket expense is only taxes and insurance. It’s true that taxes here, on a percentage basis are higher, but house prices are significantly lower. There is also no state income tax in FL. Insurance is a bit higher here because hurricane coverage is mandatory and you really need flood insurance as well. In LA earthquake was not mandatory, but we had it…which tripled our annual insurance premiums.

Take a look at the full expense comparison below!

Other changes we have made to save money

While we’re very diligent about tracking our spending, we’ll be the first to admit, we are not the most frugal people. We (luckily) made enough money in LA to prioritize convenience over extreme frugality (which will cost you a lot).

We often didn’t have too much choice however, with our demanding work schedules. Plus, when we had free time we didn’t always feel like employing “frugal restraint!”

But now that we are living less hectic and excessive lives, here are some big and small changes we have made that are saving us money.

- We get groceries at Walmart instead of Whole Foods. Shopping at Whole Foods is like buying higher-end brand clothing. You simply pay more for much of the same stuff because you like “the brand” of Whole Foods and the shopping experience. Walmart has nearly every organic item we want and it’s all cheaper. There is the moral dilemma of Walmart having low paid employees and using a deplorable amount of plastic bags (among other things I’m sure), but it’s definitely cheaper.

- We don’t have a housekeeper anymore. Admittedly, we REALLY LIKED having a housekeeper. A wonderful woman named Silvia came once a week and not only cleaned the house but did the laundry! Unfortunately, it cost us over $500 month. Now we clean our house and do our own laundry! (I know, boo hoo for you guys. hahaha). But again, we didn’t have the time before with our work schedules…or so we felt.

- We only have one car. This is possible because Joe works from home now and Kristin is mostly with our son, or blogging while he’s at school (three half-days per week). When we end up in the rare car bind, one of us just Ubers. With the invention of ride services, many people could go down to one car, and save money.

- Other smaller ways we are saving a bit include buying less new clothing, ditching regular cable, switching to a cheaper mobile phone plan, buying less toys and a few other trimmings.

How much we spent moving each time, and how we learned to do it more efficiently

So, because we moved twice in 2018, first from LA to Austin, and second from Austin to Dunedin (close to the same distance), we gained some experience in moving! The cost for each leg of the move was very different because we did it the more frugal (correct) way the second time.

- Los Angeles to Austin: Total Cost was $12,935

- Austin to Dunedin: Total Cost was $4,267

As you can see there is a huge difference here. And for clarity, the above numbers included all costs involved…the movers, trucks, flights, rental cars, boxes, tape, everything related to the move.

With the first move we used a full service company. They come to your house, put your stuff in their truck, drive to your destination and unload. We also paid them to pack “breakable” items like glassware and such. Then all three of us flew to Austin together.

On the second leg, we rented a 26’ truck, and hired local guys to help pack and unload the truck on each side. Joe drove the truck for two days by himself, while Kristin and Luca hung in Austin for two extra days, and then flew to meet Joe in Tampa (Dunedin is a coastal suburb of Tampa).

In both cases we shipped our car, and the cost was within a few hundred dollars ($1295 & $1150), because the distance was similar. We thought about towing the car on the second trip, but since Joe was driving alone, he thought it would have been tough to drive and navigate tight spots. We also had to get rental cars in both cases while we waited for the car to arrive.

How we are making money since the move

To be honest, we weren’t 100% clear on how we would be making an income at first.

We had enough savings that we were comfortable kind of winging it for a year and figuring it out. Part of the idea with going to Austin was that there was a market for our work experience there, if needed, particularly in the advertising game. But we were also hoping to give this whole “blogging thing” a chance.

Surprisingly, when Joe initially discussed his departure with his partners, they were interested in having him continue to do financial management from afar, for a monthly consulting fee. This was welcome news and something he was more than excited to keep doing. Then after leaving, other friends (who owned similar companies) asked if he would be interested in doing similar work for them. Now Joe has 5 business and 2 individual clients in this capacity.

Beyond that we do have a handful of rental properties which produce some cash flow. It’s been a crap shoot every year on how much cash that is, but it provides a little. Our real estate has mostly been a winner through development, appreciation and amortization. Additionally, we have realized some revenue from real estate this past year selling existing properties, like the one in Austin and another in Kansas City.

There is also the reality that the equity in our remaining real estate and the money in our retirement accounts is growing. So we figure if we’re only breaking even on our life in general, for a while, then we should be ok in the long run. Time will tell of course.

Finally, while blogging (or what I prefer to call the “business of education by individuals”) seems to have great income possibilities, it also seems to be a pretty serious long game. Being we are in our (very) early 40’s, have a child and a part-time day job, we just can’t put a ton of hours to it every week (or maybe we just aren’t dedicated enough..haha). Writing long and informed lessons takes time, and we are not able to work 70-80 hours per week right now. But we’re enjoying it and we think, in time, it will definitely produce some additional income. Here are some of my articles to check out.

- Big Picture Investing: Why You Need to Get in the Game Now!

- Renting vs Owning: Why You Need to Own the Real Estate You Live In (of Which You Will Be the World’s Best Renter!)

- Independent Contractor Taxes & How to Incorporate (So You can Pay Less Tax!)

Well, that’s all she (and he) wrote for now. If you are thinking of doing something similar and want to talk about it, feel free to email us: joe@playlouder.com and kristin@playlouder.com.

Until Then…

Work Smart & Play Loud

Joe and Kristin

How To Start A Blog Free Email Course

Want to see how I built a $5,000,000 blog?

In this free course, I show you how to create a blog, from the technical side all the way to earning your first income and attracting readers. Join now!

Leave a Reply