In Partnership with TransUnion.

Just a few years ago, I had around $40,000 in student loan debt. I hated having my student loan debt hang over my head. I received my first bill for my student loans right after I graduated with my MBA, and it was for several hundred dollars a month for around a decade.

The thought of paying such a large bill for so many years was just frightening to me.

So, I decided to pay off my student loans as quickly as I could.

Learning how to pay off student loans can lead to many positives, such as:

- You may finally feel less financial stress.

- You may be able to use that money towards something more important, such as saving for retirement.

- You can pursue other goals in life, such as traveling more or looking for a better job.

I know these things are true because learning how to pay off my student loans is one of the best decisions that I’ve ever made.

No, it wasn’t easy to pay off my student loans that quickly, but it was definitely worth it. No longer having those monthly payments hanging over my head is a HUGE relief, and it allowed me to follow my dreams.

Paying off my student loans also helped me move forward in life. Instead of drowning in a large monthly debt payment, I was able to move on and work towards other financial goals. I became in control of my financial situation, in control of my credit score, and more. It felt absolutely amazing to pay off my debt, especially so quickly!

And, this is something that you can do as well. You can challenge yourself, reach your financial goals, and get back on financial track. This can then help you to improve your credit score as well, if you finally pay off your debt and can move onto other financial goals of yours.

My credit score is now in the 800s, and it was actually not that hard to reach.

Whether you want to believe it or not, your credit score can play a major role in your family’s life.

While you shouldn’t go crazy and completely obsess over improving your credit score, it is important to learn more about them due to the impact they may have.

Your credit score can influence the interest rate you receive on a loan, buying a home, finding a rental home, attaining certain jobs, your insurance rates, and more.

A credit score is a three-digit number showing others your creditworthiness, and is often used as an indicator of how risky you are.

Your credit score is determined from data that is collected from businesses where you’ve completed purchases and transactions, such as from loans. This means that understanding, managing, and securing that information is extremely important when it comes to reaching your financial and other life goals.

There are tools available that make improving your credit score easy as well as accessible.

Why is improving your credit score important? What can it impact?

There are many situations where your credit score and history may be important. It is important to spend time on improving your credit score, because you never know when it may be useful.

Your credit score may impact:

- Loans (mortgage, car loan, etc.) – If you apply for a loan, your credit score and credit history will be checked. Before you are approved for a loan of any sort, the lending institution is going to thoroughly check your financial history so they don’t end up losing money on your loan.

- Home and car insurance – If you have home or car insurance, your rate may be calculated on a factor you didn’t know about – your credit score.

- Renting a home – If you have decided you don’t want to own a home, do not think you have escaped having your credit history checked. Your landlord will most likely check your credit history. They will want to know if you pay your bills on time or if you have ever skipped one completely.

- Credit cards – If you don’t care about credit, then you probably will not care about this one. However, if you want a credit card, especially one with a good rewards system in place, then you will want to work on improving your credit score.

- Employer – While employers can’t see your score, you may be surprised to know that many employers will check your credit report (with your permission). Industries that often check your credit report include those dealing with financial services, chemical, and defense.

- The interest rate you receive – A good credit score can mean you qualify for a low interest rate, and a bad credit score may mean that you get a high one.

And, this is why I recommend TransUnion.

TransUnion empowers consumers to maximize financial health by providing resources to help monitor personal information, manage credit, as well as keep your identity safe.

If you’re wondering about your credit score, I recommend checking out TransUnion’s Online Credit Score Simulator. This tool shows you ways your current credit score may change based on actions that you may take in the future (such as getting a new loan). This can show you how your actions may impact you, so that you can make better informed decisions.

How can a person improve their credit score?

Improving your credit score does not have to be difficult. Once you know what impacts your score, you can make changes to improve it.

Here is my advice for increasing your credit score:

- Pay your invoices and bills promptly.

- Check your credit report often. There is a chance that mistakes may pop up on your credit report, and this may be hurting you. If you find an error, you should fix it as soon as possible.

- Keep your balances and utilization down. I recommend spending less than 20% of your available credit.

- Keep your credit card accounts open if it makes sense (if you think you’ll go into debt with them open or if the annual fees aren’t worth it, you may want to think about closing them instead), so that you can lengthen your credit history.

- Pay your credit card on time. Even if you pay your credit cards in full each month, your balances are still reported. To improve your credit score, you should pay your credit card in full before your balances are reported.

- When shopping for a loan, apply for loans within a short period of time instead of over several months.

- Fraud protection is an important factor of maintaining your credit health, because identity thieves may take out loans or finance items that appear as delinquencies on your credit report. Due to that, I recommend TrueIdentity, a free credit and identity theft protection product designed to help consumers protect their identity from identity thieves.

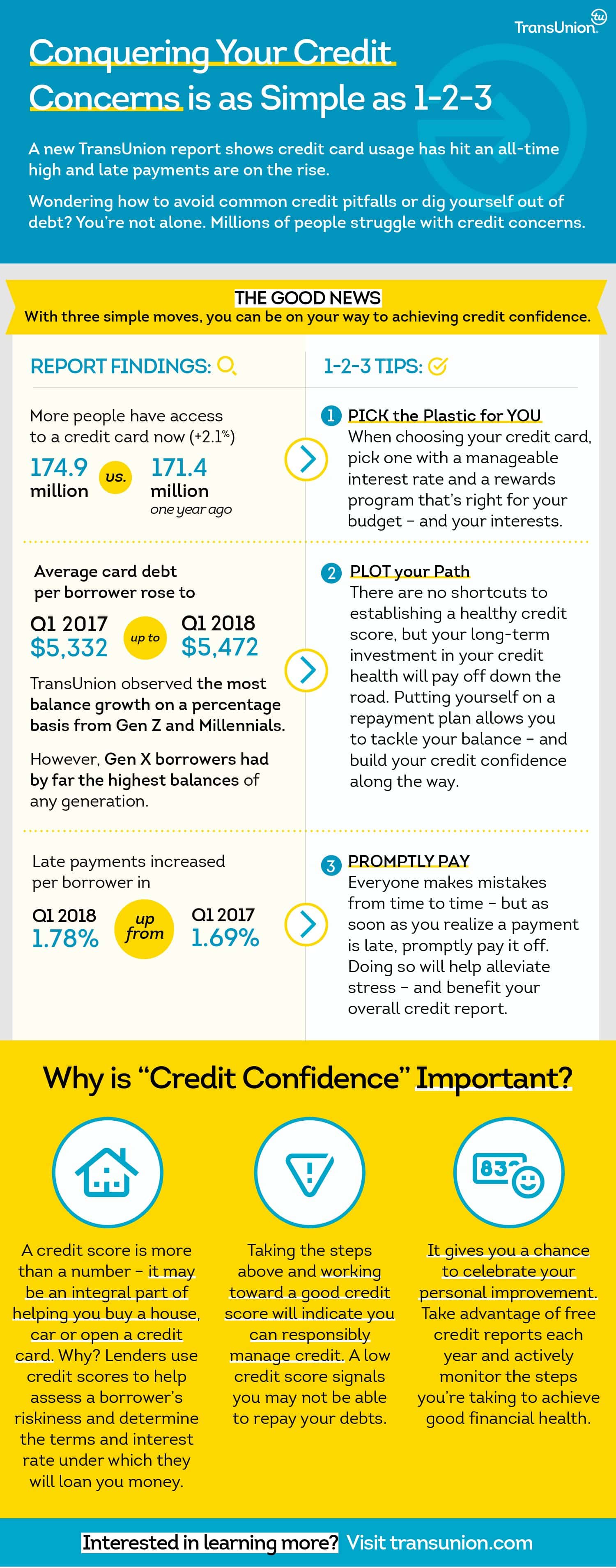

Here’s a great infographic I found from TransUnion that is helpful as well.

To learn more, please visit TransUnion.com.

Are you trying to improve your credit score?

Leave a Reply