Have you been paying attention to how much insurance is costing you these days?

Have you been paying attention to how much insurance is costing you these days?

While it is a necessity, it’s possible that you are overpaying and could benefit from learning how to save money on insurance, from car to home, and more.

I know people overpay because at one point I was overpaying. When I was 16, I had just gotten a new-to-me car. It was cheap, had high miles, and had more paint chips than actual paint.

Even though everything else about the car was overused and cheap, the insurance was over $100 a month!

My Dad helped me find a policy, and neither one of us paid much attention to the cost, which was surprising considering how frugal he was. Yes, I was a teenager and a new driver. However, neither my Dad or I did our homework and shopped around to save money on insurance, as we just used my dad’s insurance company.

Also, I had all kinds of coverage on this cheap, ugly car. I had a very low deductible (like $250 or something), and collision insurance (which usually isn’t needed for a super cheap car). Once I realized all of the mistakes I was making, I made changes and my insurance dropped by over HALF. I went from paying over $100 a month in car insurance to somewhere around $50 a month.

And, I know I’m not the only one with a story like thisI

Whenever I look over someone’s spending to find ways for them to save money, I almost ALWAYS see that they are overspending and could save money on insurance.

This applies to many different types of insurance rates, such as for your car or your home.

In fact, just the other day I was online, and someone said that their monthly car insurance payment for a $2,000 car was over $200 a month. I wish this was the first time I heard something so crazy, but it comes up all the time!

Many times, people just stick with the same insurance company, and this can lead to overspending for years, if not decades! I recently overheard someone say that they didn’t want to switch insurance companies, even though they knew they were overpaying, because they didn’t want to offend their insurance agent.

Well, let me tell you something. Your insurance agent isn’t really “yours” – they work for the company!

There’s no need to waste money on overpriced insurance. Instead, you should be finding the best value for you and your situation.

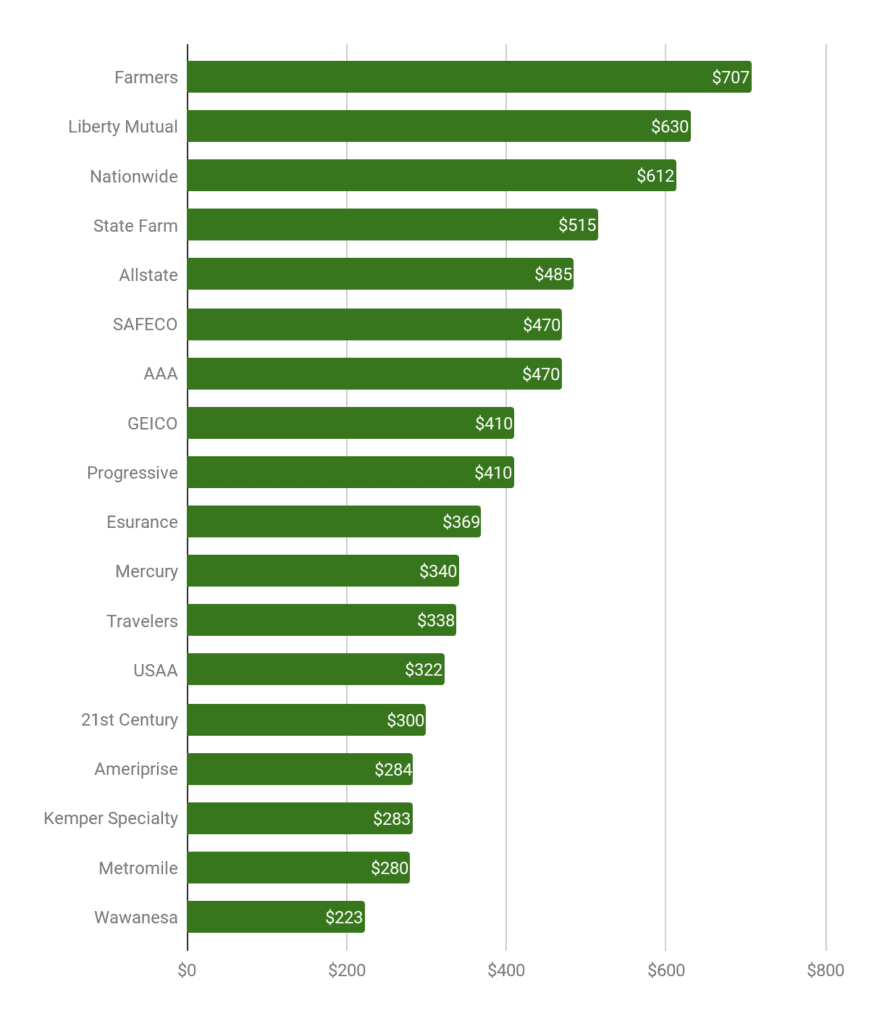

So, I decided to do some research on who is overpaying and by how much. That led me to Gabi (which is a personal insurance company that I have no relationship with, and they have no idea who I even am), and I found that customers from Farmers, Nationwide, and State Farm are overpaying most often. In fact, 87% of the time, Farmers customers were overpaying, 81% of the time for Nationwide customers, and 80% for State Farm customers. Geico was among the most competitive rates, but even then, 1 out of 3 of their customers was still overpaying.

Here’s a chart from Gabi’s website that breaks down, by company, the average amount people are overpaying for insurance:

As you can see, many people are probably overpaying for their insurance, and they probably don’t even realize it.

Here are my tips on how to save money on insurance.

What impacts how much you pay for insurance?

First, in order to save money on insurance, you need to learn about what exactly impacts your insurance rate.

For the sake of ease, I am going to simply refer to car insurance in this section.

Some of the factors that come into play for car insurance include:

- Where you live. Depending on what city and state you live in, you may pay more or less than others. This impacts your insurance rate because if your area has a higher than average amount of accidents, lots of car thefts, crazy weather, or something else, then you may have to pay more for insurance.

- Your car. A Corvette is probably going to cost more to insure that a Camry. Sorry to say, but this is definitely why you should be thinking about the WHOLE cost when deciding on what car to purchase. Your monthly and/or yearly insurance payments are directly related to the type of car you purchase. This is because certain vehicles simple will cost more money for an insurance company to fix damages.

- How you drive. Yes, the way you drive has a large impact on your insurance rate. If you get in a lot of accidents, then you are probably going to pay more than someone who never has.

- Your age. A 16-year-old is going to be charged a higher insurance rate than someone who has been driving for two decades. This is due to experience and the likelihood of getting into an accident.

- Your credit score. Yes, your credit score plays a part in your car insurance rate. The higher your credit score, the less you may have to pay for car insurance. This is because car insurance companies think that those with higher credit scores tend to be more responsible. You can check your credit score with Credit Sesame for free here!

- The coverage you choose. There are a lot of different coverage options you can choose when purchasing car insurance. This will greatly impact the rate you have to pay.

These are just a few of the many factors that will cause you to overspend or save money on insurance.

Shop around to save money on insurance

So, with the above information, you may say “well, I’ll just completely avoid the most expensive insurance companies.”

Noooo!

You should not do that. There are cases in which they may be the best for you. To save money on insurance, you should always shop around to find the best rate for you and your situation.

For us, our Jeep is insured through State Farm. And, I know that it’s the most affordable rate for me and my situation. So, that goes to show that you shouldn’t completely avoid the more expensive companies mentioned above.

Shopping around is important, but it does require you to do a little extra work. However, considering that the average person can save several hundred dollars a year, possibly over $700 even, then it can be a task that will pay off quite quickly.

I recommend shopping around for better insurance rates about once a year. One good way to do this is to use the annual renewal notice as a reminder.

Analyze your insurance coverage.

Not everyone needs some crazy policy with all of the possible options.

Some things you will want to analyze or try include:

- Your deductible amount. Some people choose the $0 or $50 deductible amount, which can lead to a significantly higher insurance payment. You should analyze whether paying the extra is worth the lower deductible. For us, we usually choose the $500, $1,000, or even the $2,000 deductible.

- Evaluate what you actually need. In some instances, you may only need liability coverage. Paying collision coverage on a $500 car may not be worthwhile, which is something you should analyze. For us, when we had cheaper cars, we would only ever get liability coverage.

- Ask for insurance discounts. Things such as the good student discount, good driving discount, etc., do exist, so you should ask about them! You probably qualify you something, and it’s money you’re just throwing away if you haven’t asked yet. And, if you don’t know what you qualify for, simply call and ask “I’m finding a more affordable car insurance policy elsewhere, what percentage discount can you offer me?” Or, ask something like “What discounts do I qualify for if I am a good/loyal/long-term/etc. customer?” The list can go on and on. If you’re not happy, just call back and try again.

- Bundle your insurance. Bundling does tend to save money. So, if you have both home and car insurance, you may want to bundle them together to see if you can get a lower insurance rate.

Remember, in many cases, your insurance agent isn’t there to help you save money on insurance. YOU need to do that yourself. Only you have your best interest in mind.

How much do you pay for home and/or car insurance? Have you ever sought out a more affordable rate? How do you save money on insurance?

Leave a Reply