Hello! Enjoy this post from a blog friend of mine.

Hello! Enjoy this post from a blog friend of mine.

I think most of us would agree that earning more would allow us to save more. Contrarily, SPENDING more is going to save you more, and I’ll illustrate how.

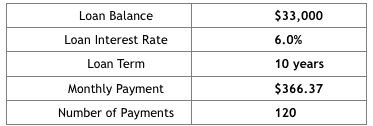

Fact. The average college graduate has $33,000 in student loans at graduation.

In a generation with abundant information, I’m always amazed at how the post-college world is mystified, and how the approach to student loans thus far has not been met with solutions, only an explanation of the problem.

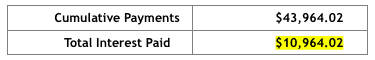

When I finished school, I started making $20 per hour designing logos for friends and family. If I worked just 5 hours per week, I’d make $400 per month. In a year that’s $4,800. That second income, the Side-Stream, was HUGE for me.

In 4 years, I’d have earned $19,200.

So let’s talk about debt and how this $20 can earn and save money at the same time.

With an average of $33,000 and a common 6% interest rate and ten-year term, you owe just under $400 per month. But with interest added, your actual debt becomes nearly 30% higher, assuming you only pay the minimum monthly payment:

Not only are you paying for 10 YEARS (into your early 30s), but you’re paying $11,000 in interest!!!

I didn’t, and you probably don’t, have more money from work to throw on to the loan without eating less steak and more Ramen. So, the only option is to earn more. If that sounds scary, and unfamiliar, you’d be surprised to find that there are people out there that would pay you for what you do well and know, even if it’s weird (read more about skill selection mentality here):

Are you really good with your calendar?

Can you swap broken phone screens?

Are you really good at teaching the binomial equation?

You might think I’m crazy, but these are actual businesses that people are using to Side-Stream.

- Google Calendar Classes

- Fix your iPhone Screen

- Tutor Kids at Elementary Math

Related: 20+ Best Jobs That Pay $20 An Hour Or More

So, let’s say you were a Psychology Major in school, and you’re already working. But, it’s not enough, and you’re just treading water financially. You contact your local school and start tutoring at the local high school for kids interested in Psychology degrees. You earn $20/hour for 5 hours per week on your Side-Streaming skill.

You walk with $100 per week, or $400 per month, and apply ALL of it to your loan.

Look at the difference it can make on debt:

By earning on the side, and applying the entire income you’re making, which is just after only 5 hours per week, or $4,800 per year, you effectively:

- Drastically reduce your debt period from 10 years to 4

- Make 49 payments rather than 120, a whopping 60% reduction

- Slice interest by 38%, from about $11,000 to $4,200

- Pay a total of $37k versus $44k, seven-thousand dollars less

SPENDING what you earn on your loan, SAVES you big money.

For some of us, scholarships or parents got us through, debt-free…at least for the moment.

Your $33,000 debt could be credit card debt, or the new car you needed. Mathematically speaking, making more and dropping it into loans can save you THOUSANDS.

If the math doesn’t convince you, there’s another perk of Side-Streaming for $20 per hour. When I started meeting with clients, negotiating rates, networking for more work, and finding solutions to other people’s problems, I actually got better at my day job.

There’s beauty in getting paid to do what you love – work doesn’t have to feel like servitude. Because my business was growing, the experience started to bleed over and suddenly I was developing at a faster rate than my work peers.

Here’s my Top 6 reasons Side-Streaming improved my work performance:

1. I was no longer afraid to outreach, network, and find new clients.

When you are operating for yourself, your motives change. At work you can coast, but when it goes directly to your pocket, you WANT to succeed, and you’ll be shocked at how much you can grow on your own just from challenging yourself to do so. When I learned how to find people that would be interested in my service, and do it over and over, I learned how to attract and market a product. No school needed – the education was experience.

2. Creative problem solving became normal for me, and work wanted more of it!

If I was asked to create a logo for a volleyball program, I wasn’t given instructions, a deadline, and a process to get through it – I had to invent it myself and find ways to make it happen. At work, where my large corporation set the stage for me to be moderately successful, I didn’t have to do any of that. When I did it for me, and brought that skill to the office, I quickly became a top performer.

3. Getting feedback from clients, and using that data to improve the service, was a habit.

When someone tells you that they like what you’ve done, and they’d happily recommend you, it’s the best thing you can hear. When someone says they wish the work had been done a little faster, or was a little crisper – it sinks in deep. Learning to evaluate and react to my clients’ needs gave me the platform to understand and collect data and use it to create more value from my service, one that carried over into my 9-to-5.

4. I could assert my skills, knowledge, and ability to an audience of peers with confidence, and politely decline to know expertise without feeling threatened.

As a Side-Streamer, I would often get asked why my service was more than a local competitor charging half. I had to not only express why I was a good use of funds, but I had to do so with confidence, asserting my expertise, speed and performance over someone else’s. I was shy, but when it was directly for me, I learned how to do it and why it was important. From my experience with high level clients, I was better equipped to handle negotiations for raises, which netted in a $16,000 raise on day 11 on a new job.

Contrarily, I’m a graphic artist, but if someone wants me to digitally paint a family portrait, I would likely decline the project, and see if I could recommend someone that would do an excellent job. Doing this in the workplace is always smarter than BS-ing what you don’t know.

5. I became quick to ask for expectations so that I could surpass them.

When I made a few mistakes on my own, I HAD to adjust. One time, I had a project thrown in my face because I didn’t listen to my client. I forgot to ask questions about his expectations (read which questions I ask now). When I sat and digested it, I realized I hadn’t done a good job of hearing, with clarity, what he wanted. In the office, when projects came up and I took initiative, I was proactive and asked for expectations, making it really easy for me to hit the mark, and exceed it.

6. Failure was often; so was Success.

It’s common to get comfortable at work after a while, but when first starting, you’re on edge and feel like you can’t fail. When you fail, you learn, right? When you touched the hot stove, did you do it again?? Failing is how you’ll grow fastest and sometimes work won’t be the place that lets you spread your wings, they just want you to follow the leader (or system). When you Side-Stream, you can learn and learn fast through the things that work and the things that don’t. The more you fail, the more you succeed, and this wasn’t a loss of my job, it was just ‘a’ job.

So maybe it sounds like fantasy?

It’s not, and more and more people are starting a Side-Stream every day. Ordinary just isn’t what we were built for.

$20 an hour, for me, was worth much more than the financial opportunity – it was an invaluable representation that I wasn’t solely reliant on my job for income, and that to me was freedom. Could I quit? No. But I had options, and if work wouldn’t give me another raise, I could go earn it myself. If I wanted to work ten hours this week or none, I could.

School to me held freedom. Freedom to learn, or eat, or meet, or party. That’s the freedom that’s missing after school. So I started chasing that freedom.

Soon, $20 an hour turned into $60, which turned into $100.

Most starting salaries don’t allow much room for increased loan payment – there’s just not enough income to do so. You need to EARN more, to SAVE more.

With zero experience, I started helping friends, or family, with art projects. One day, someone asked me for a logo for a new company, and it wasn’t long before I was teaching others to start up a second income stream.

Often, the skills we have are just untapped. Side-Streaming isn’t about reinvention, it’s about re-connection!

If you could pay off your loans early (worth a celebration I might add), and were still making an extra $4,800 per year, what you would you use it on?

Let’s get lavish – share the luxuries of living well to you! Where would you go, what would you see, what would you buy? Do you have a side income stream? Why or why not?

Leave a Reply