Happy Monday everyone! I hope you all had a great weekend and enjoyed St. Patty’s Day. I’ve decided to start combining my Saturday and Monday life posts together. I figure most of you probably don’t want to hear about my life twice a week. And I’m not that interesting… 😛 Anyways, it was a pretty relaxing and boring weekend, especially since W was sick the entire time.

I think we’ve decided to wait until next year to buy our next house. We’re not ready to sell just yet, and honestly, we still love our house. Getting rid of it so soon, especially when we haven’t found anything that we liked more to justify the cost, just seems stupid. Unless something 100% perfect comes along, then I don’t think we plan on buying this year at all. We really don’t want to buy something that we only kind of like and then end up buying another house quickly after again.

Next year is not out of the question though. It will most likely be next year when we buy, so hopefully something perfect comes up by then. I’m sure it will, but for now we’re just going to continue enjoying where we live. Lifestyle inflation has definitely been catching up with me, but we should be trying to save so that maybe we can buy the next house with cash or at least a majority of it with cash.

What made you decide to buy your second house? Was it lifestyle inflation, or you just grew out of your current house? For us it’s a mixture of both. Something with a bigger yard would be nice, and so would more than just a 1-car garage (check out my “Spending” section below for an idea about why).

For everyone who is switching over to Bloglovin after the whole Google Reader death, please click on this button if you would like to follow me via Bloglovin.

Spending

Spending

Hmmm some major spending in the past week, that is for another post though. Lets just say we bought a new car but it hasn’t been delivered yet…

Target also had almost its WHOLE Home section on sale at two Targets near my house. Let’s just say that I went to Target a total of 3 times this weekend and spent a little over $300 redoing the home decor in our living and dining room. I bought tons of things and love it all! Now I just need a new side table in the living room and I think we’ll be done (except for the fact that we still need to install carpet in the living room).

As most of you know, me and W have lived together for nearly 6 years and up until recently, never really decorated our house. Yes we have furniture and things on the wall, but nothing matches and it just looks like a disaster. Now that we have time (and more money to spend), we have decided to start decorating more. There are TONS of things that we still want to do, and I have a whole post dedicated to that and it will be published in the near future.

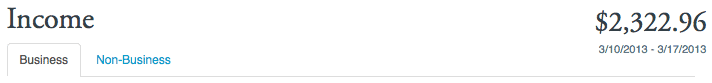

Extra Income (does not include income from our main jobs)

I received approximately $2,323 in payments in the past week. It was a good week and I would love it if it just stayed this way forever. As most of you know, extra income does not include any salary or income that we make from our jobs (I’m an analyst and he’s a car salesman). A lot of you have wondered about my schedule and how I make time for everything. Were there any specifics you wanted to know or maybe I should just make a whole post on it? Such as with my daily schedule, everything that I do, etc. Please let me know if this sounds really boring or like something you would read.

Affiliate income is still going great and I’m glad I started working on this. I do have bigger plans for this and hope to see this area of my extra income to continually increase. I’m also starting to think more about passive income. What do you do for passive income?

Me and my friend are still stuck on a name for our business. Some of you said to just think of something and change it later, but with what we want to do, the name is an important part of the business. We can’t really do much else until we start thinking of our “brand” and the name.

Food

Yet another meal plan this week! We are still doing great with eating at home 5 days a week. I’m not sure how much we spent on food last week but it was minimal. We did go out to eat twice, but it was at two places right next to our house that are super cheap (but the best Mexican and Chinese we have ever had).

How are you doing with your food budget?! If you have any tasty looking recipes from last week, please share the blog post in the comments so that I can add it to my meal plan for future weeks 🙂

- Tuesday: Pulled Pork Sandwiches

- Wednesday: Chicken Rollatini with Spinach alla Parmigiana

- Thursday: Out to eat

- Friday: Steak and vegetables

- Saturday: Out to eat

- Sunday: Breakfast for dinner (French toast, eggs, bacon)

Being healthy

I’m still doing good with this. I could be eating a little more healthier though. I’ve been eating a lot of fruit for healthy snacks. My sister still yells at me all the time for being unhealthy and she is definitely a motivator!

Leave a Reply