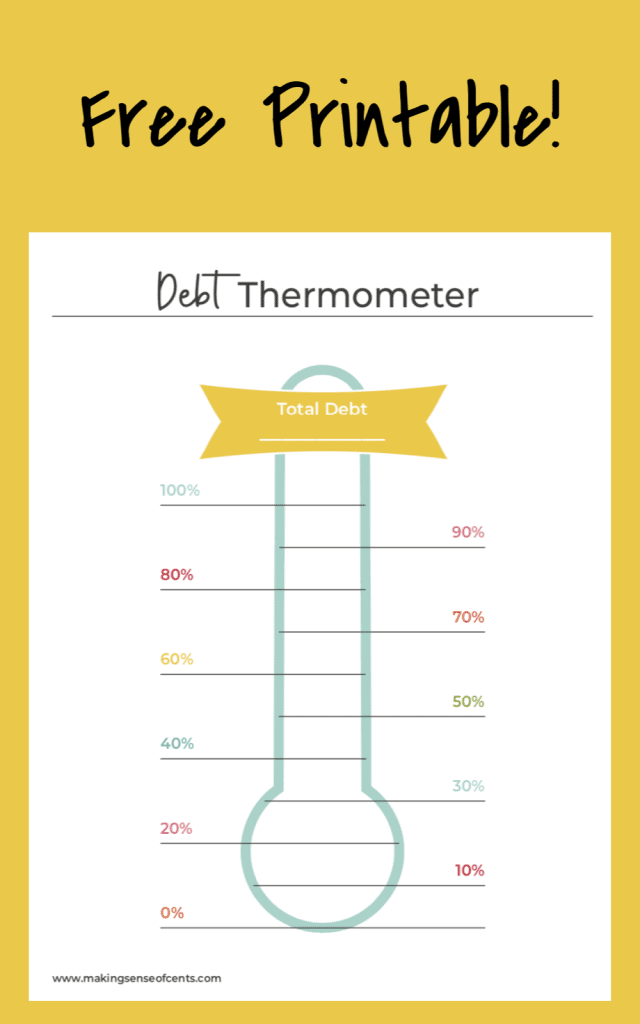

Looking for a free debt thermometer printable?

Making your goal visual is a great way to find motivation for paying off your debt and makes it easy to track your debt payoff process and become debt-free.

Having your financial goal displayed in front of you can make it that much realer, plus it’s nice to have a constant reminder of what you are working towards.

One way to do this is to have a debt thermometer.

With this free printable debt thermometer, you can keep track of your debt payoff progress.

How to use this free debt payoff thermometer printable:

- At the top, under “Total Debt,” you will write down how much debt you have.

- Then, on each line below that, I like to write out how much debt you’ll have to pay off in order to color each section. For example, if your total debt is $10,000, then each 10% amount would be $1,000.

- After you reach each level, you then color up to that line so that you can better visualize the amount of debt that you are working with.

This is an effective way to break down your debt into increments, as well as keep track of your debt payments and debt payoff journey so that you can reach your money goals within a shorter time frame.

You can download the free printable pdf by signing up below.

Whether you are using the debt snowball method or debt avalanche method, you can use this free debt printable pdf to track your progress towards financial freedom and your debt payoff goal.

Using free printables, such as this debt payoff tracker, can be helpful tools to better manage your monthly budget and get rid of your debt, such as student loans, credit card debt, and more.

Leave a Reply